Embrace complexity and win big

Efficient Markets and Interdependence

Stock markets are the sum total of millions upon millions of asset exchanges each day. Retail investor A sells to Corporation B who buys from Hedge Fund C which sells to... and so on. It is dizzyingly complex.

An emergent property of this complexity, according to the 'efficient-market hypothesis' (EMH for short) is that the collective 'Market' (which, in my head, I picture as the wizard from the Wizard of Oz movie) somehow knows the exact value of a particular asset. For instance, as of 4:00PM EST on March 21, 2024, the 'Market' says that the price of Tesla (TSLA) should be $172.82 USD--not a penny more, not a penny less.

How the market can 'know' the price of something is beyond me. It probably has something to do with supply and demand, investor sentiment, and a whole bunch of other factors, etc. I kind of think of this process as a wood-chipper working in reverse: millions of wood chips (of information, transactions, etc.) being assembled into something that has structure and life.

We're heading down a bit of a rabbit hole here, so let's get this back on track:

The important takeaway of the efficient-market hypothesis for the average "Joe Shmoe" investor like you and me is:

"Try as you might, you can't beat the market. So embrace the complexity and you will still do okay."

This is because the Market, if the EMH is to be believed, is all-seeing and all-knowing, like the Eye of Sauron from Lord of the Rings. It ceaselessly monitors every single transaction and 'prices in' any information relevant to the value of an asset.

You can't out-maneuver the Market. [Well, you can, but that would take "insider information" that will land you in jail.] Good luck trying. Even if the market is less than perfectly efficient (like Warren Buffett and others say), it would still take extraordinary luck or illegal information to beat it. This is why the vast majority (upwards of 90%) of actively managed funds, with there teams of PhDs working on super-computers, do not beat the average returns of the market over time. They might get lucky for a little while, but eventually the market wins.

Keeping pace or just slightly under-performing the market (once investing fees are factored in) is the unabashed goal of 'passive' or index investing. The index investor has no delusions that they are smarter than the market. They warmly embrace its incomprehensible complexity and, with enough time, usually come out on top with returns that make active investors jealous.

The stock market is a microcosm for the complexity of life.

From the Buddhist perspective, reality is the sum total of everything interacting with everything else. Nothing exists in isolation. You and I are connected to each other as we are connected to every other person, being, molecule, atom, physical force, idea in the universe.

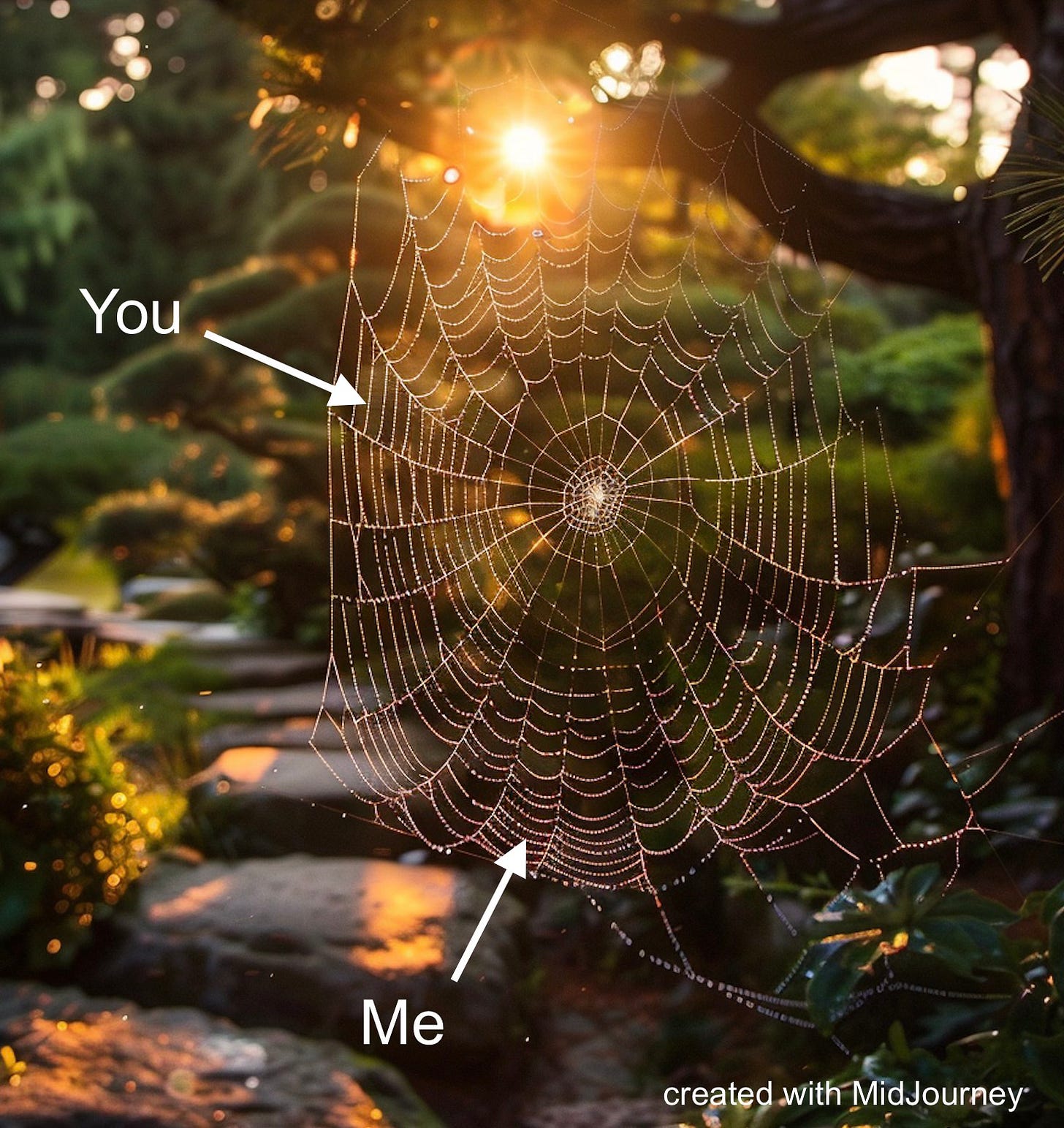

Everything is a part of a limitless web of connections. A change in one part of this web (say, you buying TSLA shares) will have a ripple (or domino) effect through the rest of the web (your buddy Mike also buying TSLA, Elon Musk sending yet another ill-advised tweet, the NASDAQ tanking, the world entering a global recession, etc.).

Buddhists throw around various terms for this notion, including dependent origination, interdependence and Pratītyasamutpāda (in the ancient language of Pali).

Embracing interdependence is one of the ways that we can see the ultimate truth of reality and live a more awakened life. I get that this sounds a bit metaphysical and woo-woo, but it is absolutely crucial to our happiness and living a rich life.

Acknowledging that we are merely one strand of a giant web of interconnection can help us feel closer to those around us. We can act more compassionately with the knowledge that our words and actions have immediate and potentially far-reaching effects on the world.

Interdependence, like the Market, prices in everything we do, say, think and how we interact with those around us. Buying into this notion is the spiritual equivalent of buying a broad-market index fund like VEQT or VUN (which I hold personally).

Owning these funds allows you to embrace the enormous, complex, interrelated mess that it is the stock market. The more warmly you embrace it, the richer you will become.

Similarly, in accepting the complexity and interrelatedness of reality, we set ourselves up for a windfall in our relationships--with each other, other beings, our planet and the universe in general.

Summed up in a snappy quote:

"Accept the complexity and interdependence of reality, and you will live a richer life."

- The Buddh-i$h Investor

Further Reading/Viewing:

- "What is Dependent Origination?" from Tricycle's Buddhism for Beginners

- PWL’s Benjamin Felix on "Is the Market Efficient?":