Hearing things in the shower

Pattern-hungry brains, noisy markets, and the stories we tell ourselves

Do you ever hear strange sounds in the shower?

I do. All the time.

I hear the sound of my infant son crying… but he’s no longer an infant.

I hear my wife making coffee in the kitchen… but she’s already at work.

I hear my phone ping… but it’s charging on another floor.

At this point, you’re probably thinking that the Buddh-ish Investor is finally losing it. Or that my shower is haunted. Or that I need to call a plumber.

But it’s none of those things.

What I’m experiencing is auditory pareidolia, a well-documented scientific phenomenon in which the brain misinterprets random or ambiguous sounds, like rushing water, as something familiar and meaningful: a crying baby, a loved one’s voice, a phone notification.

It’s not a hallucination.

It’s just my brain doing its thing.

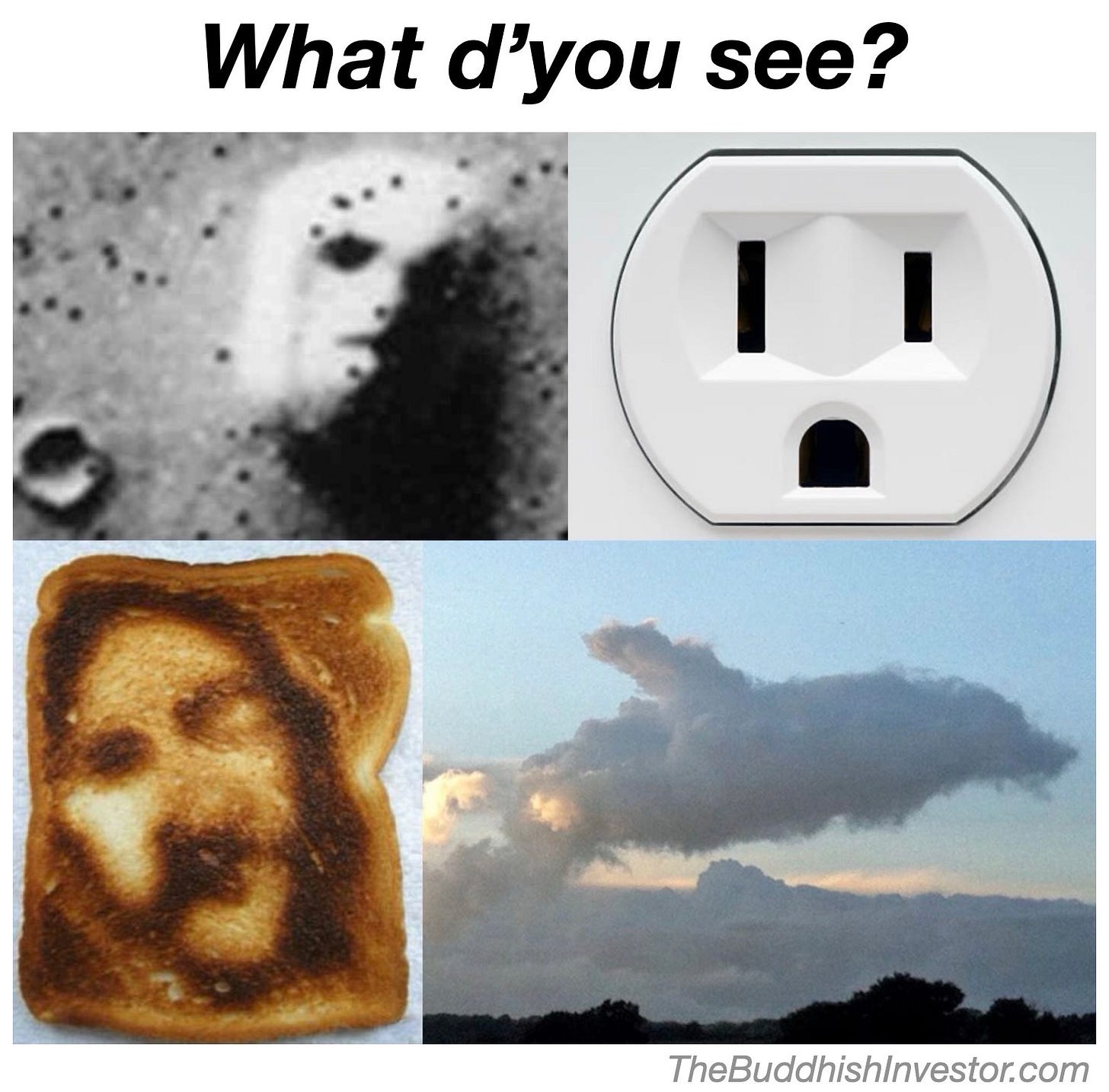

Our eyes do the same thing. Check this out:

Try as you might, you can’t not see faces on the surface of Mars, in an electrical outlet, or on a slice of toast. Or that unmistakable dolphin floating in the sky.

Our brains can’t help themselves. They are sense-making machines.

Our pattern-hungry brains

When we’re faced with randomness, whether it’s water noise in a shower or clouds in the sky, the mind does what it was designed to do: it fills in meaning. Even when none is there.

This broad tendency to find patterns in noise has been called patternicity. Pareidolia is simply one vivid expression of that deeper impulse.

Patternicity isn’t just a quirky bug in the human brain. It’s probably one of the reasons we’re still here.

Our ancestors evolved in environments where missing a real pattern—say, signs of a predator—was far more costly than falsely detecting one. A false alarm meant a spike of anxiety. A missed signal could mean death. So natural selection favoured brains that erred on the side of seeing something rather than nothing.

There may be no sabre-toothed tigers lurking in shopping malls today, but we still carry that same pattern-hungry brain around in our modern skulls.

And that instinct doesn’t switch off when we open our investing accounts.

Stock market pareidolia

Investors, like everyone else, love patterns. We love spotting trends, streaks, and shapes in market data. Maybe—just maybe—we’ve found something that will help us avoid a painful loss or capture a spectacular gain.

Which investor hasn’t bought a stock after a strong run-up, quietly assuming that the “pattern” would continue?1

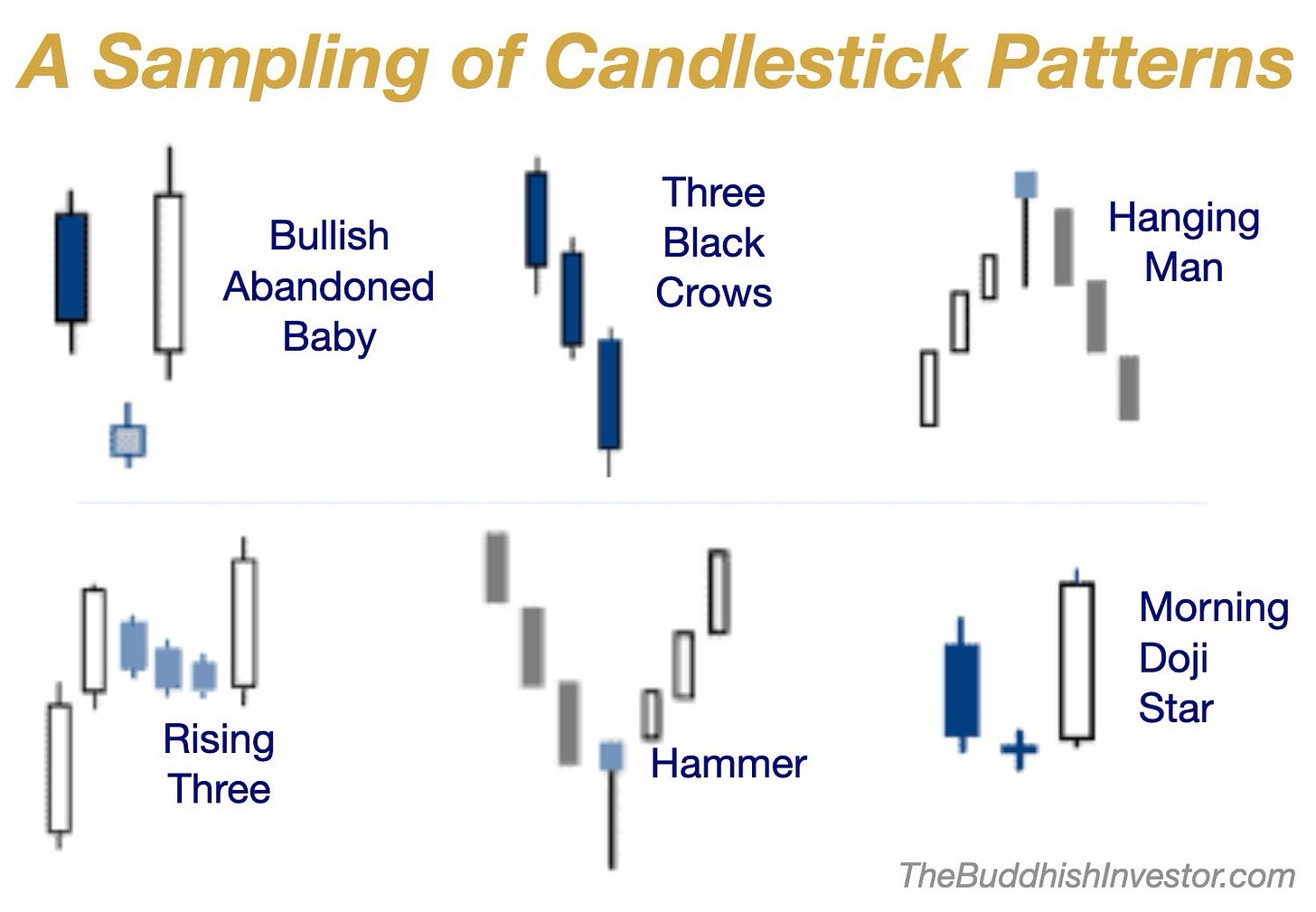

Perhaps there’s no better illustration of patternicity in investing than candlestick charts.

Candlesticks compress a stock’s price movements over a given period (minute, day, week) into neat little shapes. Clean visual summaries of messy reality. Here’s an example from NVIDIA on December 19, 2025:

Over time, investors have named and catalogued countless candlestick patterns. Entire books and web sites are devoted to them. To give you a flavour, some of the more famous patterns include names like “bullish abandoned baby,” “three black crows” and “hammer”:

And—my personal favourite—the Adam and Eve candle pattern:

Did American Eagle actually go on a tear in the fall of 2024, as predicted by the Adam and Eve pattern?

Honestly, I can’t even be bothered to check.

I don’t use candlestick patterns in making investing decisions2. While they probably do a better job of predicting market movements than tortilla Jesus, I think of them as the investing equivalent of hearing noises in the shower.

They take something noisy and ambiguous—price movements—and overlay a compelling pattern on top of it. But just because a pattern appears doesn’t mean there’s anything real there to respond to.

The danger here is that we mistake the pattern for a promise—and end up making a regrettable investing decision as a result.

Patternicity, as helpful as it has been to us as a species, can cause similar troubles in the rest of our lives.

The problem with patterns and what to do about it

Faced with uncertainty and randomness, our brains stitch together stories that feel explanatory and comforting, even when they rest on little more than noise. The problem isn’t that we look for patterns. The problem is how rarely we notice when we’ve invented them. We do it constantly in daily life. We read intent into a short email. Meaning into a friend’s silence. Causation into coincidence. Destiny into a brief streak of good or bad luck.

Getting the wrong end of the stick like this can land us in all sorts of trouble: seeing threats where none exist, blaming ourselves for random misfortunes, getting pulled into unnecessary conflict—you name it.

Buddhism can help here.

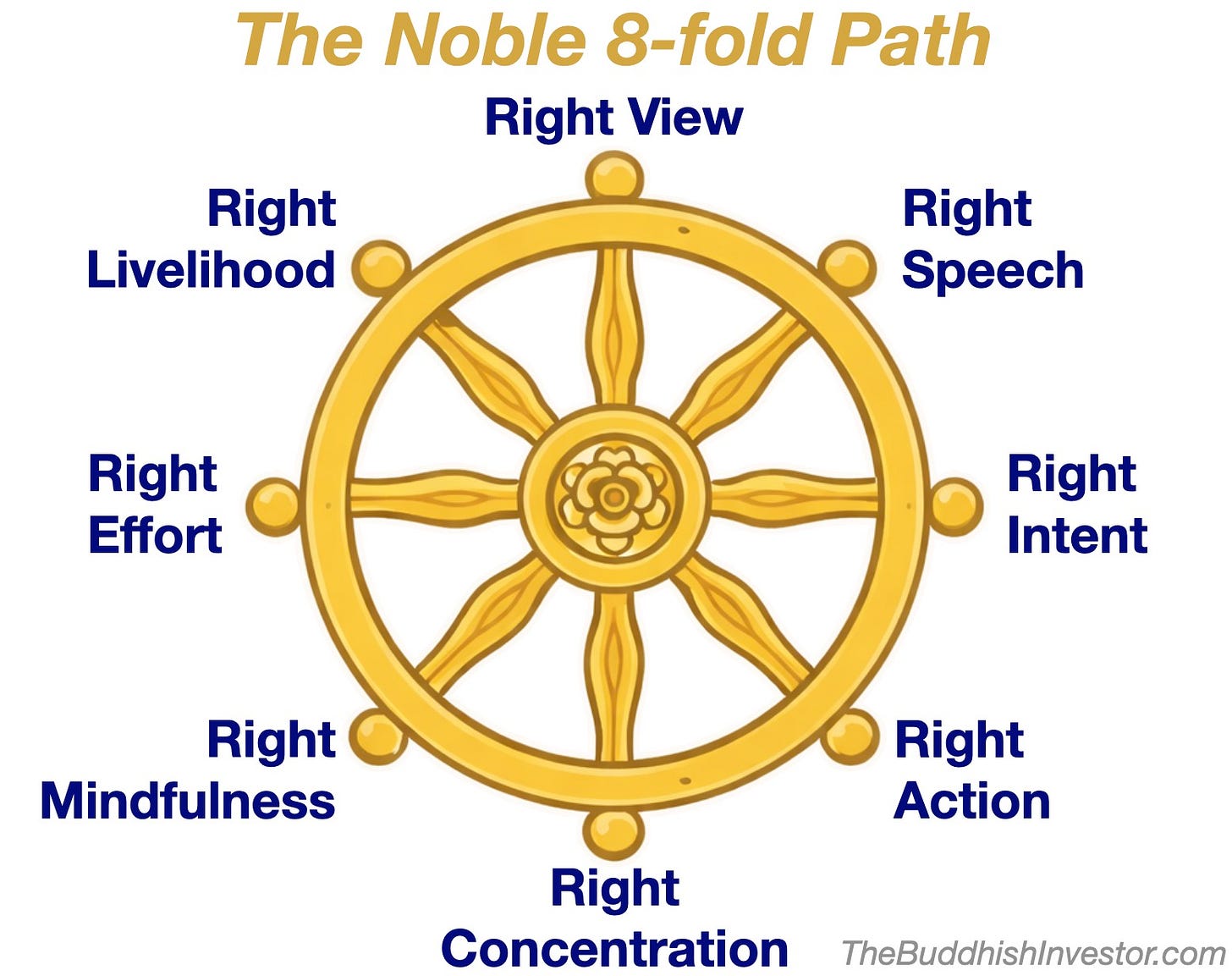

The Buddha laid out a path for us to follow to reduce our suffering. One of the steps on that path he called “Right View”.

Right view isn’t about having the correct explanation for what’s happening—it’s about seeing clearly how quickly the mind turns noise into meaning. We still hear the sounds in the shower and notice the patterns in markets or relationships, but we stop assuming they’re telling the whole truth.

Holding our interpretations lightly creates space for curiosity. It naturally invites questions like: What might I be missing here? What assumptions am I treating as facts?

This curiosity sets the stage for us to be more compassionate—toward others and toward ourselves. When things go wrong, we don’t have to assume it’s because we failed or someone is out to get us.

Life is far more complex than we can fathom. There are countless factors shaping our lives that we’ll never fully see. And there’s randomness too.

While we can’t stop our brains from reacting to noise—hearing babies cry in the shower or spotting patterns in market charts—we do have a choice about what we do next.

When I hear crying through the rush of water, I don’t assume something is wrong. I recognize it for what it usually is: noise being shaped into meaning by a well-intentioned but overzealous brain.

The same habit serves us well in investing and in life. Notice the pattern. Acknowledge the story. Then step back and ask whether anything real is actually happening.

- The Buddh-ish Investor

I’d love to hear from you! Email at Sangha@TheBuddhishInvestor.com or drop a comment below!

Take home points:

Our brains naturally turn noise into patterns, in the shower, in relationships, and in markets.

Problems arise when we treat those patterns as facts and act on them with too much certainty.

Right view means noticing the story the mind tells—and holding it lightly before reacting.

If you’re looking for more:

If you want to go down the rabbit hole on candlestick patterns, check out ThePatternSite.com

And if you want to go down the Jesus tortilla rabbit hole, check this out: Christ on the Comal

I certainly have, but that’ll be a story for another time.

Don’t get me wrong—I’m sure lots of investors much smarter and savvier than me would attest to the usefulness of candlestick patterns. To each their own.