Investors Remain Calm (and Don’t Go Berserk)

Stories of equanimous hippos and unfazed farmers

I'm home with my toddler son today. He's getting over a round of the dreaded hand-foot-mouth disease. [Pray that you don't ever get this!]

He's been on a steady diet of childrens books over the past few days to compensate for the lack of oral intake.

One of those books is Hippos Remain Calm by Sandra Boynton. It's a spin-off of her 1977 classic Hippos Go Berserk!, which recounts a night-long raver of a house party with 40+ hippos:

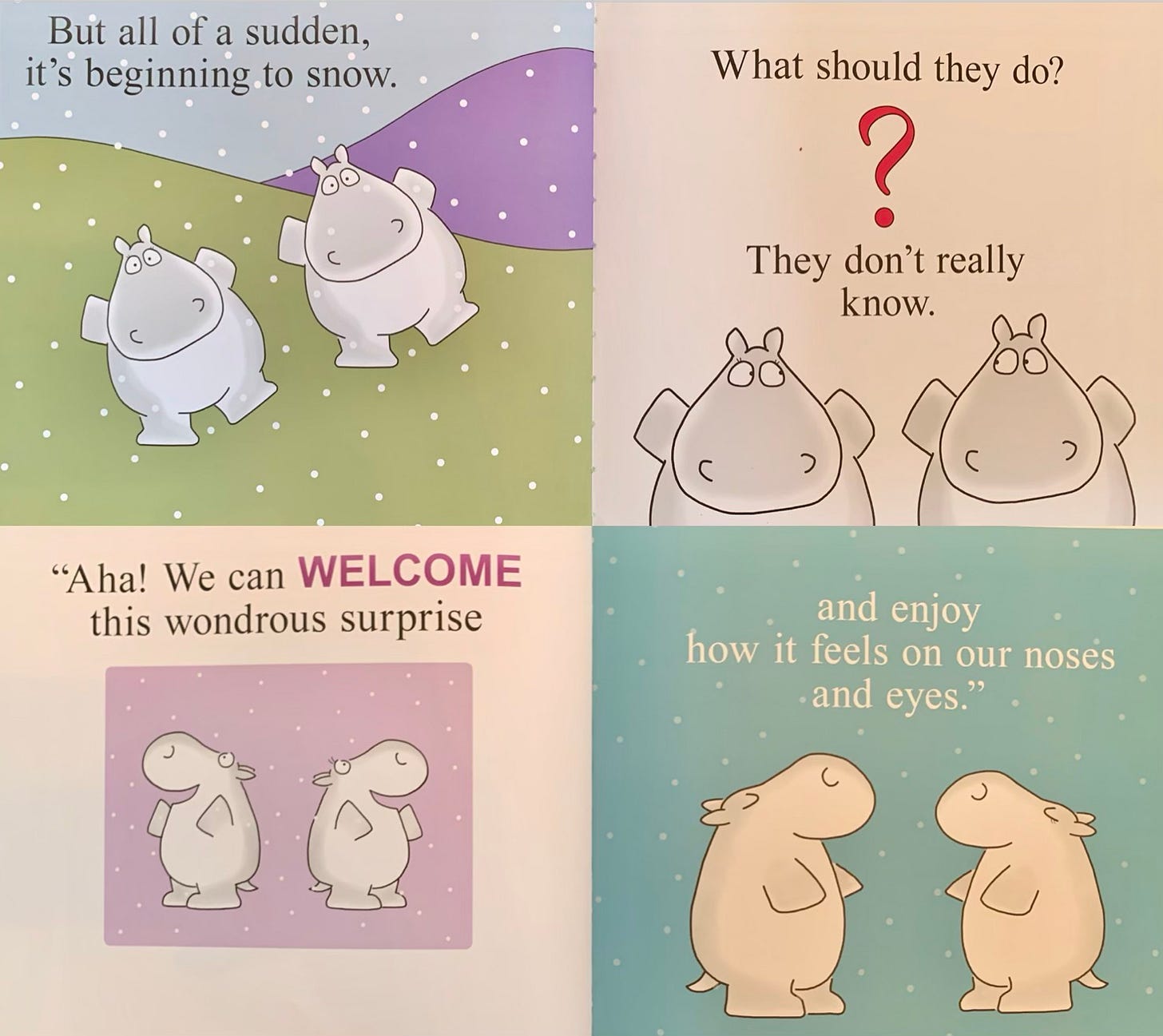

The two hippo protagonists of Calm end up at this house party and go a little berserk, but mostly remain quite calm. Even in the face of adversity:

After reading Calm for the hundredth time, it finally dawned on me that Boynton is teaching her readers about equanimity. Here’s my favourite definition of this oft-throw-around term:

Equanimity is stability and equipoise in the face of life’s changes and challenges—an unshakable ease that doesn’t rely on the need for things to go our way but instead arises from understanding and accepting things as they are.

- Vanessa Zuisei Goddard, writing for Tricycle

I don't think my 2-year-old son quite grasps the concept of equanimity, but, then again, I don't think most adults that I know truly grasp it either. Myself included.

We humans just don't like surprises. We don't like the feeling of not being in control. Pema Chodron said it beautifully:

"As human beings we share a tendency to scramble for certainty whenever we realize that everything around us is in flux...But in truth, the very nature of our existence is forever in flux. Everything keeps changing, whether we're aware of it or not. What a predicament! We seem doomed to suffer simply because we have a deep-seated fear of how things really are.” - Pema Chodron

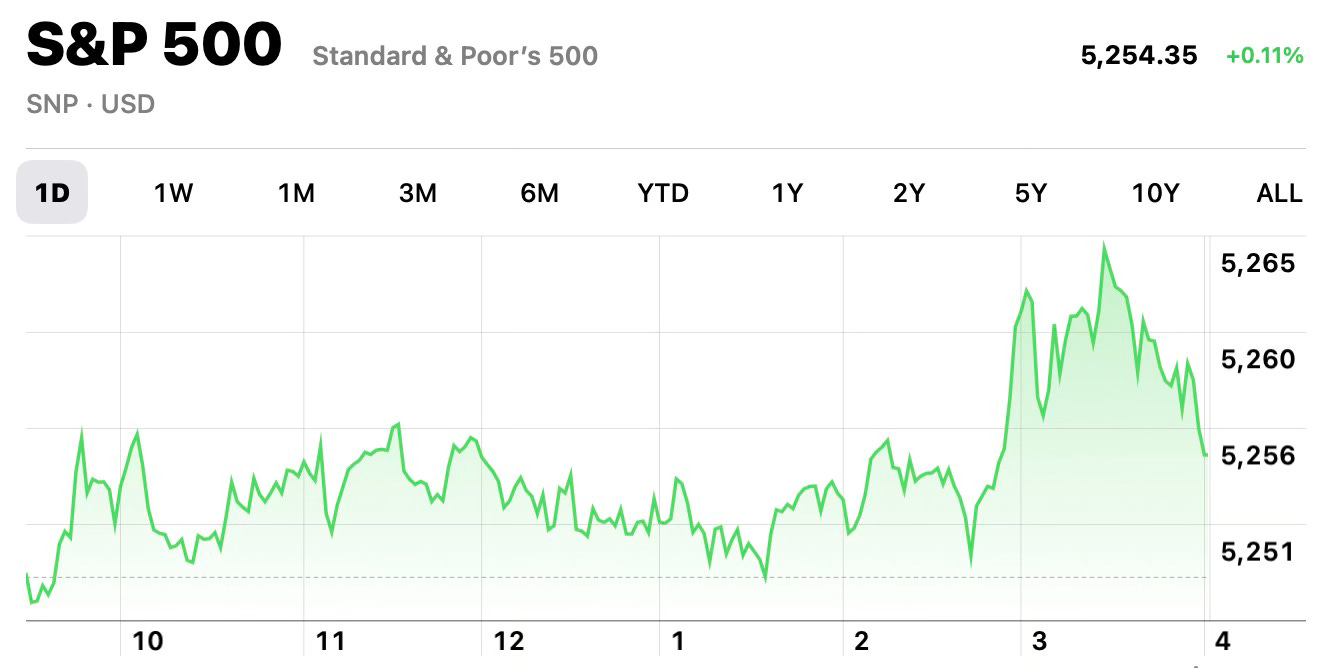

"Flux" or change is the order of the day when it comes to investing. The market rises and falls on a minute-to-minute basis on any given trading day:

And there are many valleys and peaks in the longer term too:

This constant flux can be hard to come to terms with. Even after 10 years of investing, my heart still skips a beat whenever I steal a furtive glance at the intra-day numbers for my portfolio. This is a little reminder that life is not quite as certain or controllable as I delude myself into thinking it is.

This delusion or resistance of reality forms the basis of suffering in life according to the Buddha. It is the fundamental predicament we face as human beings. We crave certainty, but there can be no certainty. We don't like surprises, but there will always be surprises.

I had a surprise myself the other day. It's tax season in Canada, and I've been crunching some numbers with my accountant. In his characteristically dispassionate tone, he informed me that I owe the CRA (Canada's equivalent of the IRS) a big chunk of the interest I had been earning on a high-interest savings account (HISA) ETF over the past year.

I had parked some cash in a HISA ETF (more about them here) hoping to net a >5% return (not market-beating, but pretty tidy return for a low-risk investment). But, once taxes were factored in, this return was slashed by a factor of 50%. The CRA is pocketing half of my returns.

My initial reaction was surprise, anger and a few curse words hurled at the CRA. I went a little berserk.

But, after a few days and a lesson in equanimity from the calm hippos, I feel better about the whole thing.

Another story about equanimity helped—this one a Daoist parable as told by Alan Watts (and borrowed from here):

“Once upon a time, there was a Chinese farmer who lost a horse. All the neighbors came around that evening and said, ‘That’s too bad.’ And, the farmer said, ‘Maybe.’

The next day the horse came back and brought seven wild horses with it. All the neighbors came around and said, ‘Why, that’s great, isn’t it?’ And, he said, ‘Maybe.’

The next day his son, who was attempting to tame one of these horses and was riding it, was thrown and broke his leg. All the neighbors came around in the evening and said, ‘Well, that’s too bad, isn’t it?’ And, he said, ‘Maybe.’

The next day the conscription officers came around looking for people for the army, and they rejected his son because he had a broken leg. All the neighbors came around that evening and said, ‘Isn’t that wonderful?’ And, he said, ‘Maybe.'”

The farmer, like our hippo friends, is unfazed by surprises. He's been around long enough to know that surprises—even calamitous ones—can often bring unexpected outcomes. Runaway horse brings back a bunch more. Son's broken leg keeps him off the front lines. And so on.

Keeping an open mind about how events play out can help us side-step some of the suffering that comes from resisting reality and our delusion of control.

Applying the farmer's "Maybe" attitude to my own tax surprise, I realized that some good is coming out of it: The unexpected tax bill was a wake-up call to me, as a die-hard do-it-yourself (DIY) investor, that I haven’t got it all figured out (especially when it comes to taxation) and I need some help. This has set me down a path to finding a fee-only financial advisor to help with financial planning. Fee-only advisors are an option worth considering for DIY investors who want to retain control (or at least the illusion of control) over their finances, but get an expert to take a quick peak under the hood to make sure you’re on the right path.

So the next time you encounter a surprise—in the investing world or the rest of your life—think of the equanimous hippos and our friend the unfazed farmer. Life is uncertain, but maybe that's not necessarily a bad thing.

Yours in curiosity,

- The Buddh-i$h Investor

Further reading/listening:

Some fee-only financial planners in Canada (I can’t personally vouch for any of these):

Canadian Advice-Only Planner Directory from Steadyhand

Ben Felix and Mark Soth overview investment taxation (in Canada): https://moneyscope.ca/2024/03/15/episode-9-taxable-investing-in-canada/

Here’s a great—free—guided meditation from 10% Happier that I’ve used when facing uncertainty in my own life: