Why Bitcoin Makes Us Uncomfortable

And what that reveals about our view of reality

Suppose you’re selling a house. You put up a listing, and two offers come in:

One buyer offers $1 million in cash.

Another offers $1 million worth of Bitcoin.

Which would you take?

I know my answer. And I’d wager most people would take the million dollars in cash. Cash feels like the safer bet. Cash is what we know and trust.

But some would take the Bitcoin.

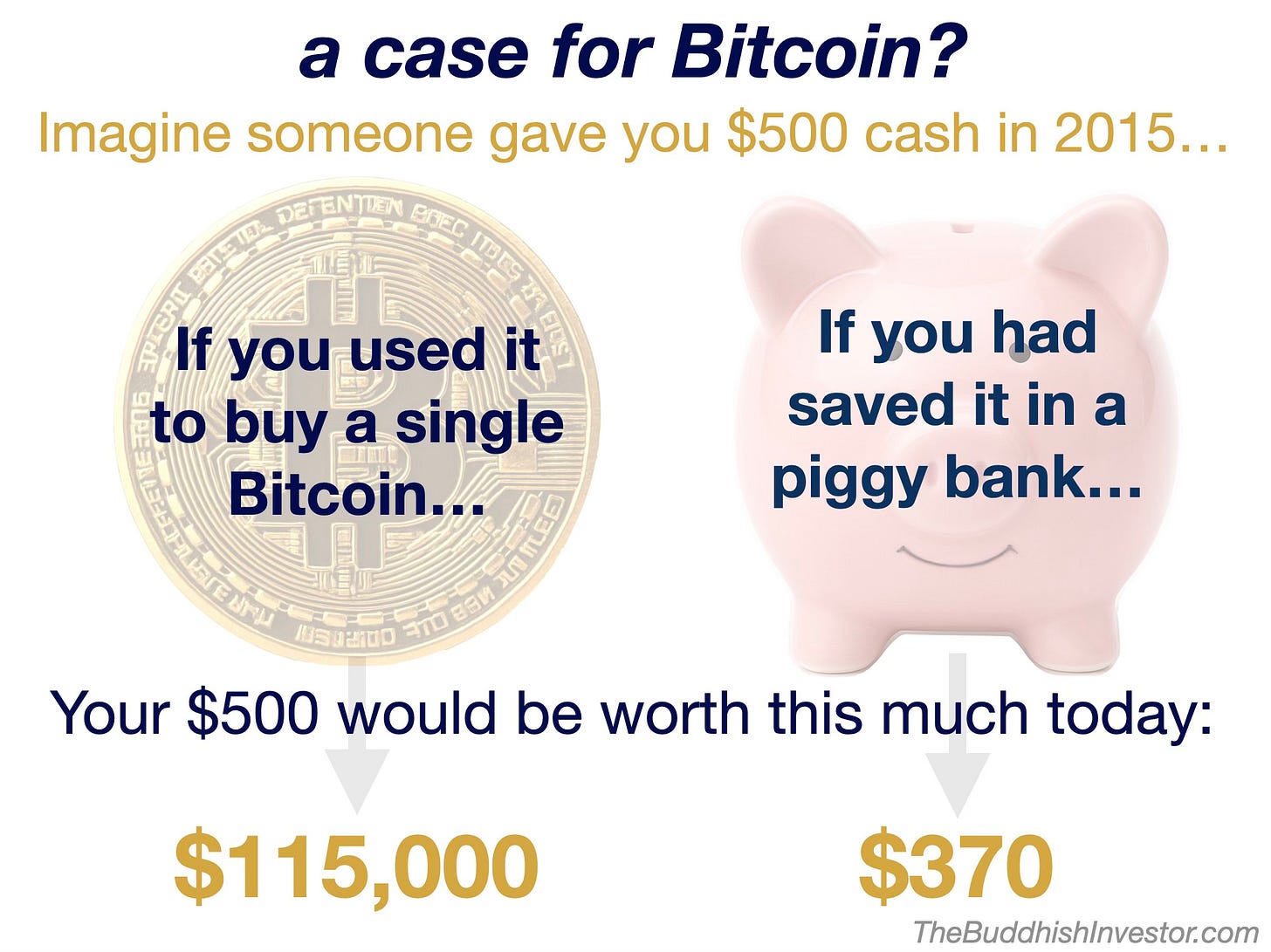

They’d point to the astronomical rise in the cryptocurrency’s value over the years:

They’d also point out that Bitcoin is going more mainstream. Major financial institutions, like JPMorgan and Morgan Stanley, are starting to take interest. Heck, you can even use Bitcoin to buy real-world things: cars, houses and over-priced pizza.

Despite Bitcoin’s growing value and adoption, many people remain cautious or hesitant. Some of it comes down to the wild price swings. Some of it is all the bad press—the scams, the crashes, the environmental concerns.

I think there’s a deeper reason that rarely surfaces in these debates, one that gets to the heart of why Bitcoin feels so unsettling to so many people:

Bitcoin challenges our deeply held ideas about what currency should be.

When you think “currency,” you think cash, bills, coins, bank vaults. You think of something tangible, backed by governments, printed in secure facilities. You don’t think of numbers on a screen, of blockchain, of something that exists purely as distributed data.

Bitcoin strips away the trappings of traditional money. In doing so, it disrupts how we see the world.

Simplifying the world in order to live in it

There’s a concept in Buddhism called signlessness.

It teaches that reality is not what it seems. We assign signs—labels, concepts, categories—to every aspect of life and reality in order to function in the world. Without these labels, we’d be lost. Reality is far too complex for us to wrap our heads around unless we simplify it.

Money is a perfect example of a sign. It’s worthless paper or metal, but we collectively, as a society, assign great value to it. We use it as a means to exchange goods, time, and labor. We all trust in it.

Imagine a world in which we didn’t all trust in the sign of money. How would you react, the next time you’re at the store, and the teller refuses to accept your $20 bill saying “that’s just a worthless piece of paper”?

Modern life relies utterly on the sign of money. It makes the world go ‘round.

When our labels become prisons

As useful (and necessary) as signs are, they also carry heavy baggage with them. They can cause us a great deal of suffering, particularly when we hold too firmly to a sign or when we mistake the sign for reality itself. In doing so, we close ourselves off from a deeper understanding of what’s actually in front of us.

Here’s an example. Think about your last negative encounter with another person, whether at home, at work, or in passing. Maybe your brain immediately labeled them: jerk, narcissist, or <insert political party affiliation here>:

Your mind came up with a convenient label and an associated narrative. But in doing so, it glossed over the complexity of that person.

No one is just a jerk. They’re a whole human being with a history, with struggles you can’t see, with good days and bad days. Maybe that person is going through something devastating right now. Maybe they just received terrible news. Maybe they’re dealing with chronic pain or grief or fear that has nothing to do with you.

The sign or label we assign to a person doesn’t do them justice.

A real-world Bitcoin use case: Teaching us about signlessness

Signlessness teaches us to reach for a deeper understanding, to hold our labels lightly, to remember that our categories are useful fictions, not ultimate truths.

Perhaps the best “use case” for Bitcoin is the valuable lesson it teaches us about our beliefs around money and the world in general:

Our unwillingness to see the full reality beyond the sign—that Bitcoin is a viable currency or that jerk is actually a suffering human—causes suffering.

It keeps us from understanding others. It keeps us from adapting to change. It keeps us trapped in a narrower version of reality than the one that actually exists.

The real question isn’t whether you’d take the Bitcoin or the cash.

The real question is: what do your signs prevent you from seeing?

- The Buddh-ish Investor

I’d love to hear from you! Email at Sangha@TheBuddhishInvestor.com or drop a comment below!

Take home points:

Bitcoin feels uncomfortable to many people not just because of volatility or risk, but because it challenges our fundamental assumptions about what money “should be.”

We suffer when we mistake our signs and labels for reality.

If you’re looking for more:

Noah Rasheta unpacks signlessness on the Secular Buddhism podcast:

If you have your doubts about Bitcoin, best steer clear of Shitcoins (yes, that’s their actual name):

The signlessness lens is a brilliant way to frame the Morgan Stanley/JPMorgan adoption story. When instituions like these embrace Bitcoin, they're essentially forcing traditional finance to release its grip on the old signs of what money should look like. Your point about mistaking signs for reality is exactly what's happening with people who reject Bitcoin because it doesn't match their mental model of currency. The real transformation happens when we recognize that cash is just as much a collective agreement as Bitcoin is.