Why Wall Street’s tantrums don’t faze me—but my toddler’s do

Investing and life get easier when we stop overestimating our control

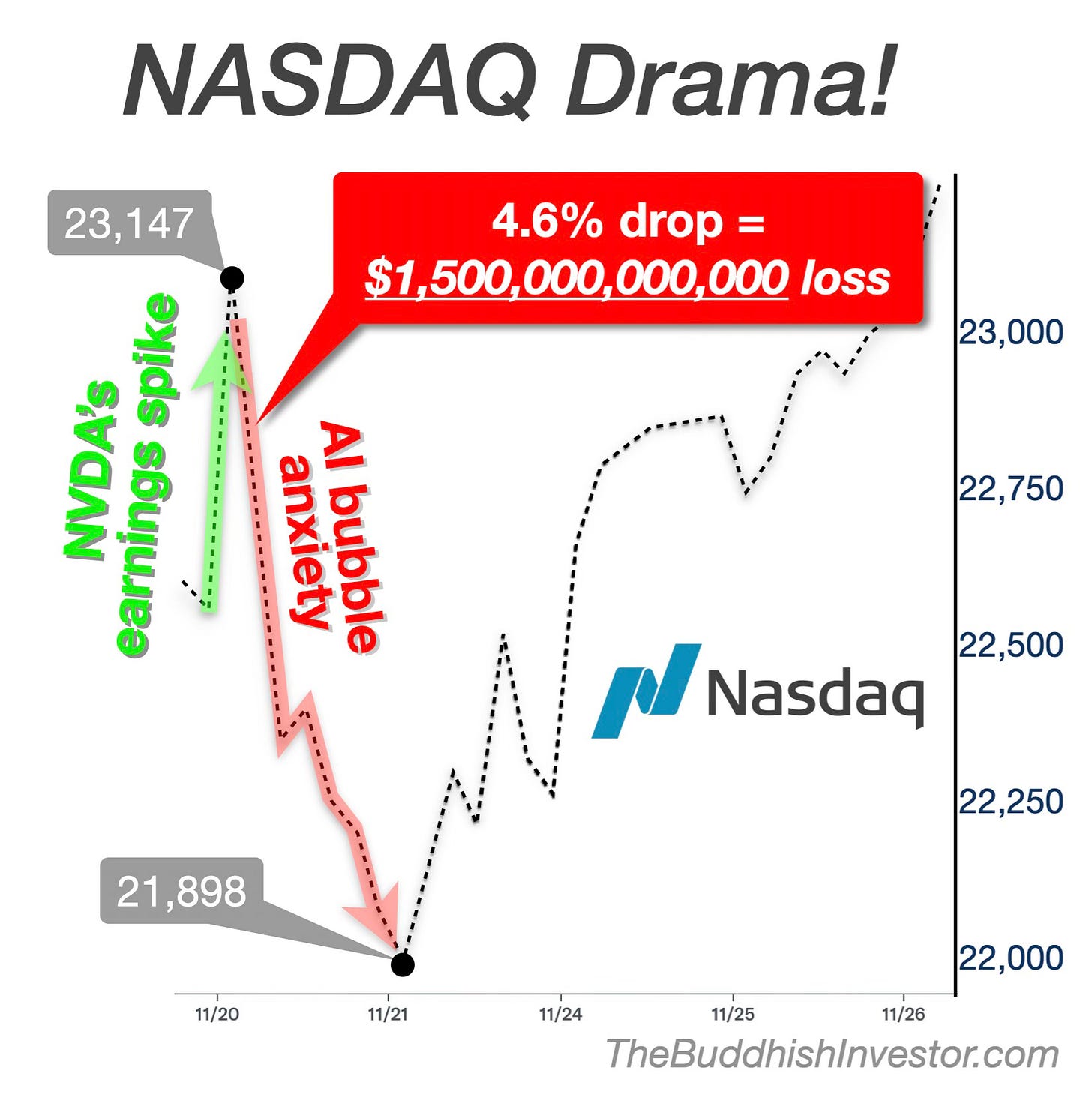

Things got a bit crazy on the NASDAQ last month:

On November 20th, the index spiked to a high of 23,147 on the news of NVIDIA’s blowout earnings.

Within hours, this euphoria gave way to jitters of an “AI bubble” and the NASDAQ fell by 4.6%—about $1.5 trillion dollars in value wiped out almost immediately.

Headlines were screaming…

…but I didn’t bat an eye. Meh.

It still surprises me—how little I react to market volatility. My family has a lot tied up in the market: years of savings, our safety net, our future dreams. The stakes couldn’t be higher. And yet when the market lurches, I just… shrug.

But if my three-year-old pees his pants at daycare? I spiral.

What’s with that?

The Illusion of Control

Here’s the difference, as far as I can tell:

With investing, I’ve fully accepted that I have no control.

Wars break out. Tariffs appear overnight. CEO scandals erupt. Interest rates zig when I expect them to zag. None of this has anything to do with me.

I can’t predict recessions or stop policymakers, but I can choose how I invest. And I’ve chosen passive, globally diversified investing—the financial equivalent of a bear hug around the unknowability of markets. I don’t pretend I’m steering the ship.

But in my daily life?

I’m gripping the steering wheel like everything depends on me.

If my son has an accident at daycare, I immediately assume I should’ve coached him more. If Thanksgiving dinner turns out great, I take the victory lap. If my wife gets angry at me… well, that is probably my fault.

I definitely influence how things unfold in my life.

But how much, really?

One Captain… Out of a Thousand

A Buddhist monk named Kusala Bhikshu once put a number to it.

Kusala is a harmonica-playing, animal-loving, seventy-something monk in Los Angeles who has spent his life serving the community. He likes to say:

Okay. So I’m the captain of my life, but there are 999 other co-captains at the wheel.

Kusala’s words are humbling. Am I really that much at the whim of the universe?

But they’re also deeply refreshing.

Sharing the Blame (and Credit)

Most of the time, my life feels more like a rollercoaster than a ship. I’m strapped in the front seat, feeling queasy with every up and down.

Taking Kusala’s words to heart gives me an off-ramp from this wild ride.

A huge amount of suffering comes from the tiny bit of control I do have. When something goes wrong, I assume it’s my fault. If only I’d planned better. If only I’d been more patient. If only I’d seen it coming.

But there are 999 other forces at play: timing, weather, moods, biology, random chance, other people’s choices… and so on.

They deserve some blame too.

And honestly? They deserve some credit when things go well.

This mindset has helped me chill out, be kinder to myself, and stop taking every bump in the road as a moral commentary on my competence.

A Small Story From Yesterday

Yesterday my son woke up way too early at 6:00 AM, demanded candy for breakfast, and then refused to get ready for daycare. Meanwhile, I had an 8:30 meeting that I couldn’t miss.

Old me would have spiralled: Did I put him to bed too late? Am I giving him too much sugar? Why does this always happen when I’ve got a meeting I can’t miss?!

Instead, I took a breath and reminded myself of the 999 other captains at the wheel:

He’s in a developmental phase.

He’s getting over a cold.

He’s three.

I’m just one cause out of a thousand.

So I gave him a vitamin D gummy, put a tutu over his snowsuit (don’t ask), and somehow got him to daycare in time for me to swing a coffee before the meeting.

It wasn’t perfect. But it worked.

Just Like the Market

It’s exactly the same with investing.

If we obsess over every bump—like the NASDAQ’s drop last month—we make ourselves miserable. We end up surprised, disappointed, reactive… and often we do the worst possible thing: we bail out of the market.

But when we accept the radical uncontrollability of markets, we can stay invested through the chaos and come out ahead.

And when we accept the radical uncontrollability of life, we can stay grounded through its chaos and come out kinder, wiser, and more resilient.

In both cases, we stop gripping the wheel and start enjoying the ride. Wee!

- The Buddh-ish Investor

I’d love to hear from you! Email at Sangha@TheBuddhishInvestor.com or drop a comment below!

Take home points:

You control only a small part of what happens in life and markets, so stop treating every outcome like it’s all on you.

Letting go of the illusion of control helps you stay calm, adaptable, and steady through both market swings and everyday chaos.

If you’re looking for more:

If you’re looking for more Kusala, check out his podcast:

FYI: https://www.bogleheads.org/forum/viewtopic.php?p=8612637#p8612637