Death (and inner peace) by a 1,000 cuts

The outsized effect of 1% investing fees and 5-minute meditations

If Sam Bankman-Fried had been up to his fraudulent tricks back in 10th century China, there’s a chance he might’ve been punished with lingchi or “death by a thousand cuts.”

Thankfully for SBF (and the rest of humanity), this nasty, drawn-out form of torture was abolished in the early 1900’s.1

Lingchi is the stuff of nightmares. Take this account from English journalist Sir Henry Norman from 1895:

"[The executioner] grasping handfuls from the fleshy parts of the body such as the thighs and breasts slices them away ... the limbs are cut off piecemeal at the wrists and ankles, the elbows and knees, shoulders and hips. Finally the condemned is stabbed to the heart and the head is cut off."

*Shudders*

Lingchi for your wealth

While the practice of lingchi has been (mercifully) relegated to the trash bin of history, it is figuratively very much alive today:

Nickel-and-diming is the modern equivalent of lingchi.

It seems like we’re getting nickel-and-dimed for everything these days.

Nowhere is this more egregious than in the world of investing. Particularly if you live in Canada.

Retail investors like you and I are getting lingchi’d at every turn: trading fees, trailing commissions, account fees, and, most costly of all, management expense ratios (MERs). The MER is basically the cost of managing and operating a mutual fund, ETF or other product.

Investment fees are more than just annoying. They add up. To illustrate:

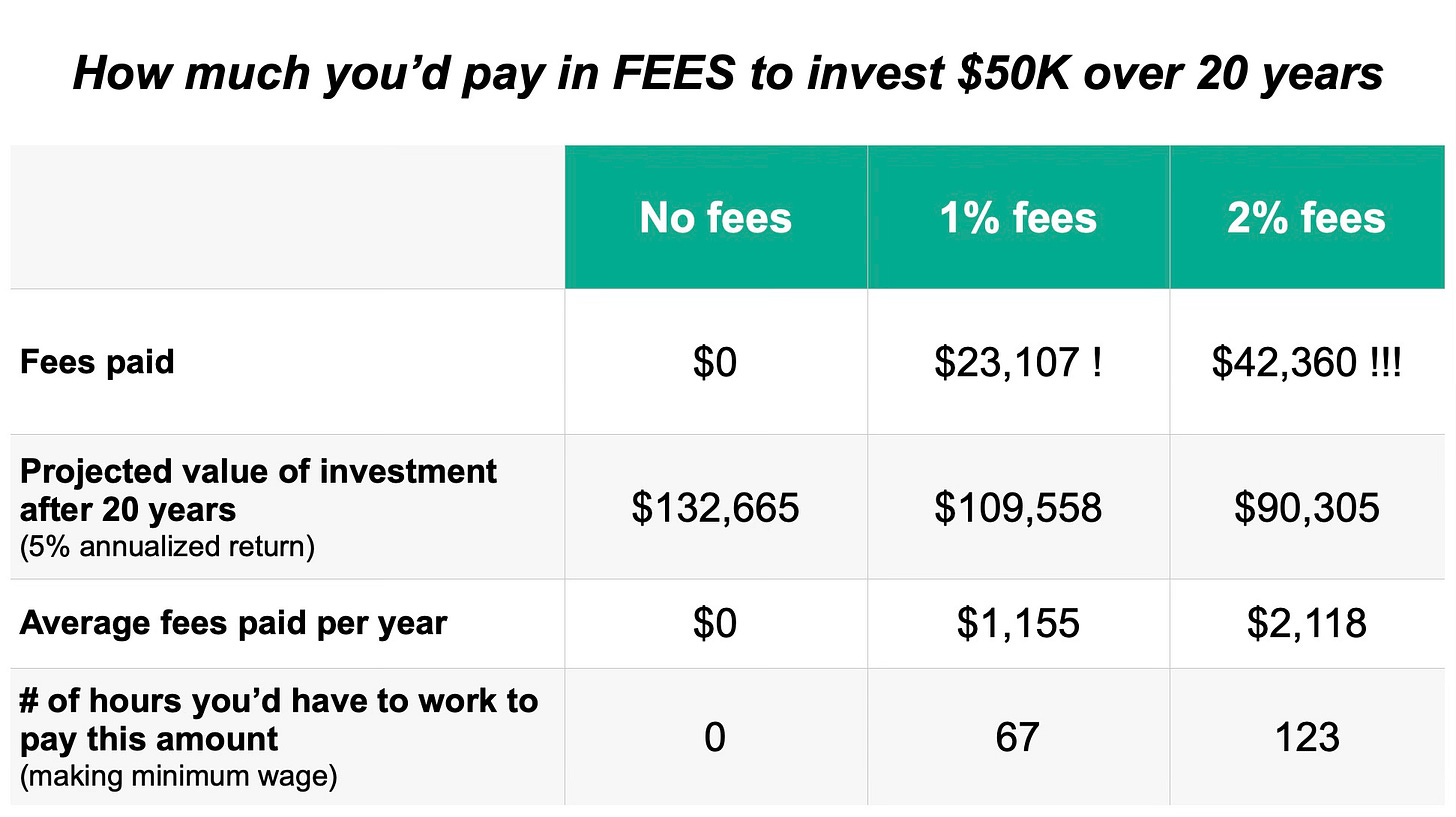

Say you invested $50,000 twenty years ago and your investment grew an average of 5% per year over that time. Here’s the damage depending on how much you’re paying in yearly fees:

$2,118/year is a machete-sized slash in this hypothetical 20-year financial lingchi.

It’s a shocking amount. But for many Canadian retail investors, this is only a conservative estimate of fees paid.

Investment fee lingchi: A scourge in Canada, but we’re catching on

The sad reality is that (too) many Canadians are invested in mutual funds costing them upwards of 2% in fees every year (looking at you, Big Banks). This works out to over $40K in fees over 20 years in our hypothetical example above. Death by a thousand investing fees.

Worse still is that these are largely hidden fees. Not deliberately hidden2, but certainly not easy to find. In the past decade of investing, I’ve never been told how much I’ve paid to hold a particular investment. Not once. You need to dig to find it.

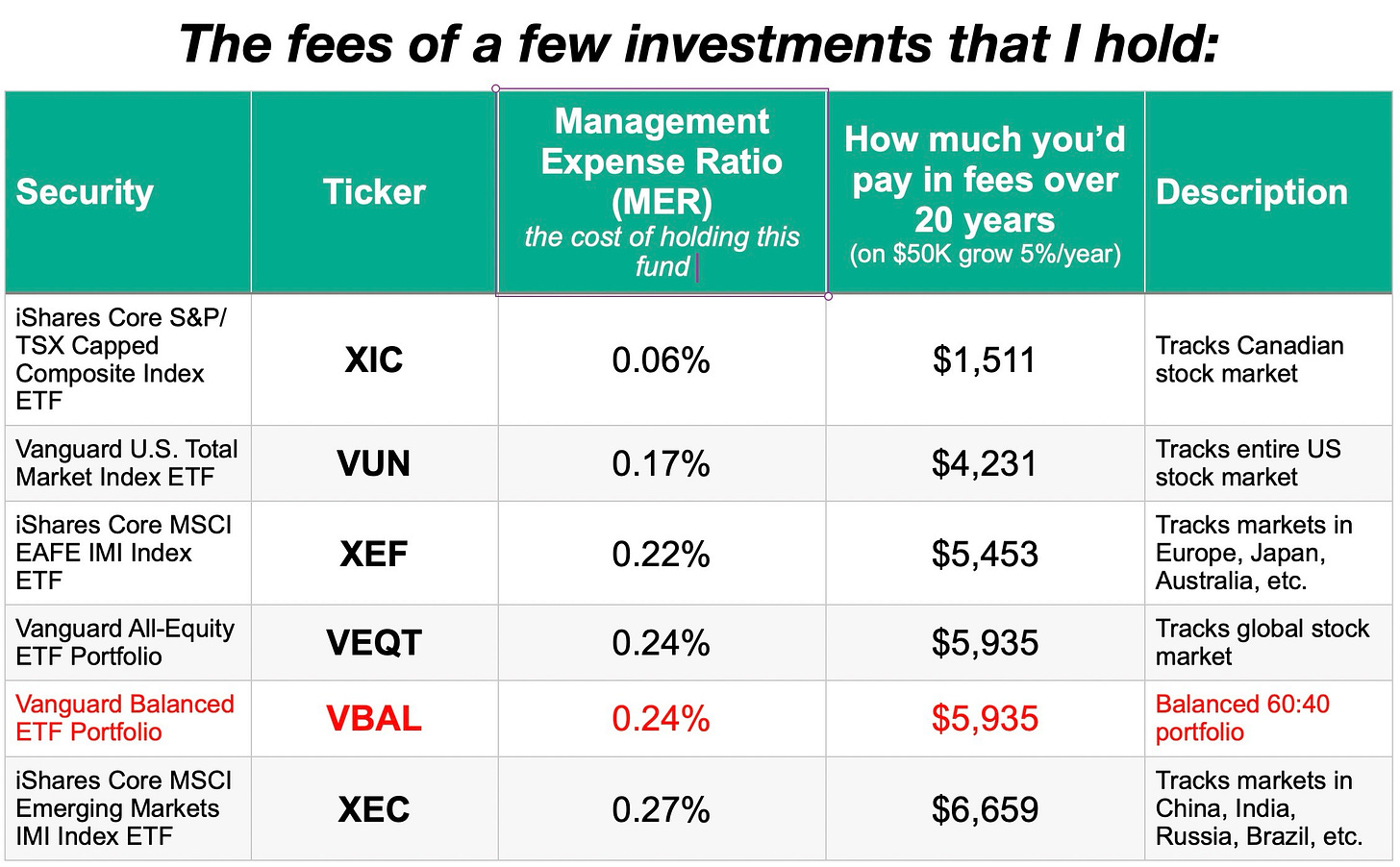

Fortunately, people are starting to catch on. Instead of pricey mutual funds, the preferred investment vehicles in Canada for decades, investors are increasingly turning to dirt-cheap ETFs (exchange traded funds), which are only a fraction of the cost to hold. Like these ETFs that I hold myself:

Take VBAL for example. It’s one of Vanguard’s “all-in-one” ETFs. It holds over 19,000 stocks and 13,000 bonds spread over global markets. It’s a great, one-stop-shopping option for investors who want to be broadly diversified, but don’t want to pay extortionate fees.

VBAL’s 0.24% MER is a fraction of that of the many overpriced funds being hawked in Canada. Such as Fidelity’s All-in-One Balanced ETF. This fund’s 1.7% MER is 7x greater than VBAL’s despite the fact that the two funds are virtually identical in the most important respects (e.g., asset allocation, geographic distribution, etc.)3.

In our example above, the Fidelity fund would cost you $36,952 in fees over 20 years. [Yes, you read that right.] By contrast, VBAL’s $5,935 price tag seems like a total deal (although admittedly still a non-trivial amount of money).

VBAL is a butterknife compared to Fidelity’s machete when it comes to investing fee lingchi:

Ask yourself the question “how big is the knife"?” the next time you’re eying a new investment. Minimizing fees is one of the few things in your control in building wealth over time (along with diversification and a long time horizon).

Lingchi your way to inner peace

The outsized cumulative effect of seemingly trivial investing fees is a vivid example of the power of compounding.

In the investing world, we typically hear more about the wealth-making effect of compounding money over a long period of time.

But, as we’ve seen, compounding works the other way too.

Compounding also works in other parts of our lives. James Clear, author of mega-bestseller Atomic Habits, talks about the 1% rule:

…improving by 1 percent isn’t particularly notable—sometimes it isn’t even noticeable—but it can be far more meaningful, especially in the long run. The difference a tiny improvement can make over time is astounding. Here’s how the math works out: if you can get 1 percent better each day for one year, you’ll end up 37 times better by the time you’re done.

- James Clear, Atomic Habits

The benefits of mindfulness and Buddhism have added up in a similar way in my life. Maybe not 37%. Maybe not even 10% (nod to Dan Harris). Maybe just 1%. I see it every day in my life in little ways:

I’ve noticed that I’m 1%…

…more acquainted with how I feel emotions in my body. Anger shows up in my jaw, worry in my forehead, disappointment in my stomach, etc.

…more self-compassionate. My inner narrator sometimes stops to consider that there are other factors at play when something bad happens in my life.

…more attentive in conversation with other people.

…better at not living on my phone.

…more grateful for all the good things that I have in my life.

…more content to just be. I don’t have to be constantly doing something to validate my existence.

And in my investing life, I’m 1%…

…more okay with the fluctuations of the market.

…more inclined to buy and actually hold.

…less sucked in by feelings of FOMO. [Have you seen NVDA’s performance in the past year?!]

These changes have happened one butterknife slash at a time over the years: a 5-minute meditation, contemplating a Zen koan over coffee, stopping to feel my breath in the middle of a work day, etc.

My ego and habitual reactivity and talent for self-inflicted suffering are being whittled away little by little. Enlightenment by lingchi.

Kind of like this sign I ran past in High Park in Toronto back in the fall. Check out its post—eaten away by a million passes of a whipper-snipper4 (and maybe a beaver bite or two):

One of these days, the sign will fall over, the victim of whipper-snipper lingchi, and we’ll again be reminded of the power of little things, whether a 1% fee or a 5-minute meditation.

- The Buddh-i$h Investor

Take home points:

Given enough time, small changes will compound to great effect—disastrous or stupendous.

Investing fees, especially MERs, can significantly erode wealth over time, so do your best to minimize them (e.g., buy low-cost ETFs).

The benefits of mindfulness and walking the Buddhist path (e.g., reduced emotional reactivity, more skillful living, less self-inflicted suffering) accumulate slowly but undeniably.

If you’re looking for more:

A great overview of investing fees in Canada from SavvyNewCanadians.com

Taylor Swift can even make lingchi catchy:

But thankfully for the investing world, SBF is behind bars for the next 20-something years.

Not anymore at least. Things were much shadier prior to the Client Relationship Model 2 (CRM2) coming into effect back in 2017.

Sure they’ve mixed in a bit of cryptocurrency, but is that enough to justify an additional ~1.5% fee per year? I’m not convinced.

Also known as: string trimmers, weed eaters, lawn trimmers and, my personal favourite, weed whackers.

Was flabbergasted to hear (on the latest Rational Reminder episode) that 80% of fund assets in Canada are sitting in actively managed funds (with their high fees)! Financial lingchi is indeed very much alive in the "Great White North."