Fear, Greed & Signlessness

What the VIX and other market indicators can tell us about the nature of reality

Unless you're an algorithm, investing is emotional.

Everything we do as humans is emotional. We like to think we're rational beings, operating out of the frontal cortex, making carefully considered decisions. But most of the time our amygdala's got us shooting from the hip.

The stock market gets that investing is emotional. It prices it in. It even quantifies it.

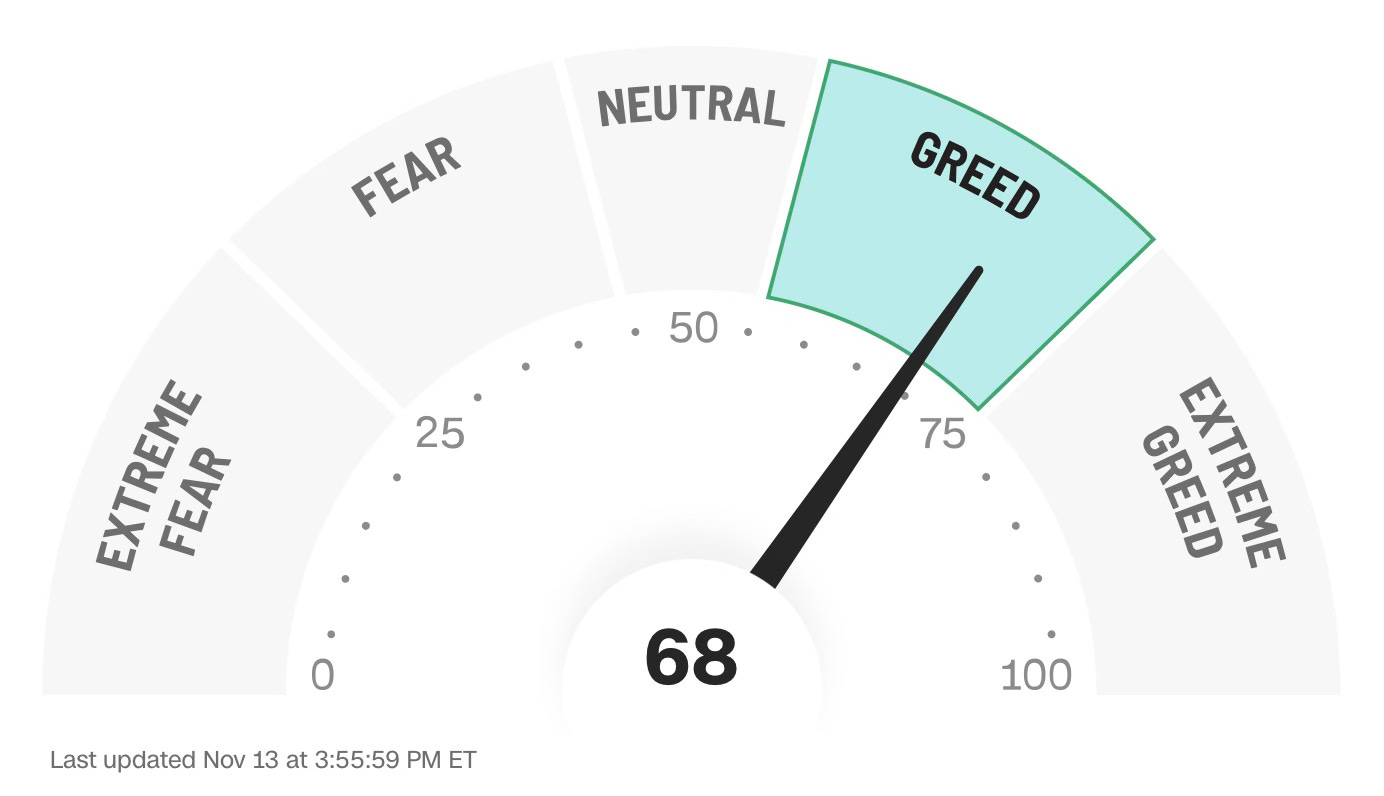

Check out CNN's Fear & Greed Index some time:

The Fear & Greed Index is touted as a “helpful way to assess market sentiment.” It spits out a score of how fearful or greedy investors are feeling based on seven factors, including market volatility.

VIX: An indicator of volatility

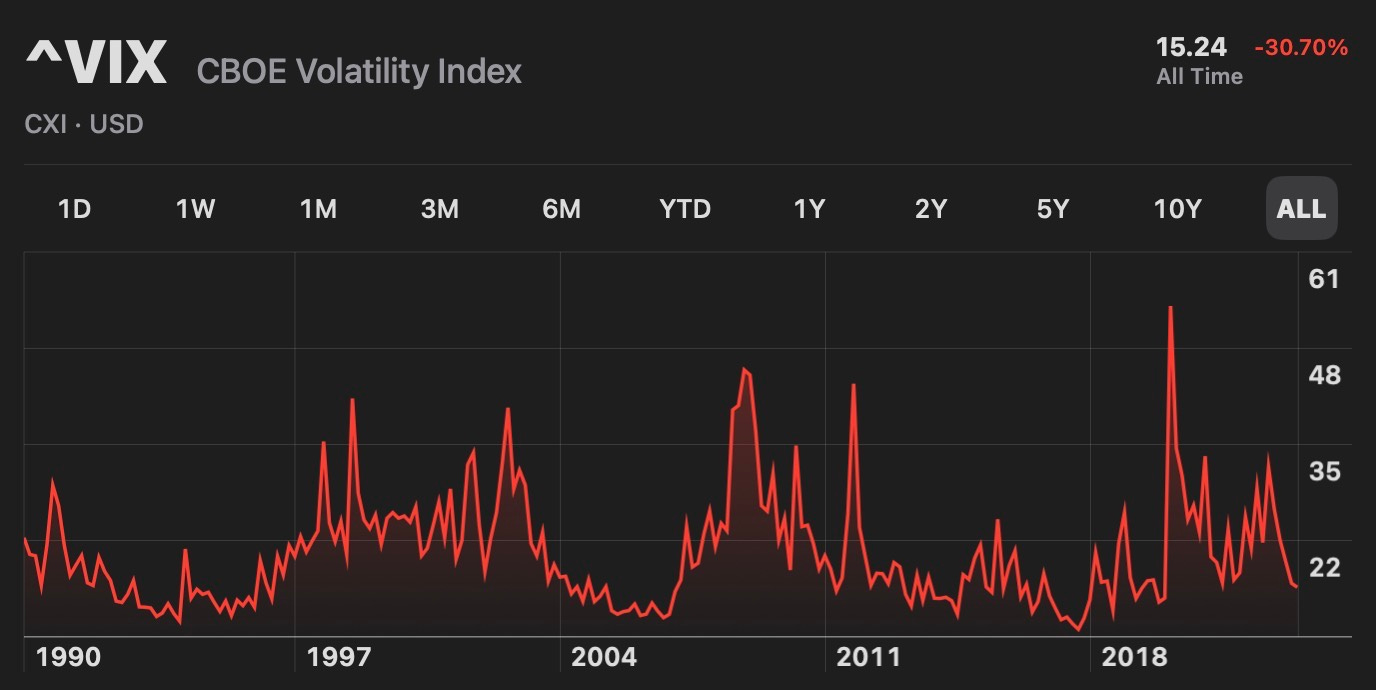

Volatility, with its terrifying lows and ecstatic highs, is what gets our hearts racing as investors and churns our emotions. It’s the obsession of investing media like BNN and MSNBC.

Volatility looks like this:

It should be no surprise that the VIX, the most widely used barometer of market volatility, is itself incredibly volatile. Volatile market conditions make investors go crazy, which, in turn, fuels even more volatility.

The VIX is a market indicator. Indicators are statistical tools designed to forecast where the stock market is heading. You might’ve encountered indicators before if you’ve spent any time watching BNN: moving averages, relative strength index, etc.1

In the case of the VIX, options trading data (e.g., puts, calls, and all that fun) are used to predict the expected volatility of the stock market, specifically the S&P5002, over the coming 30 days3.

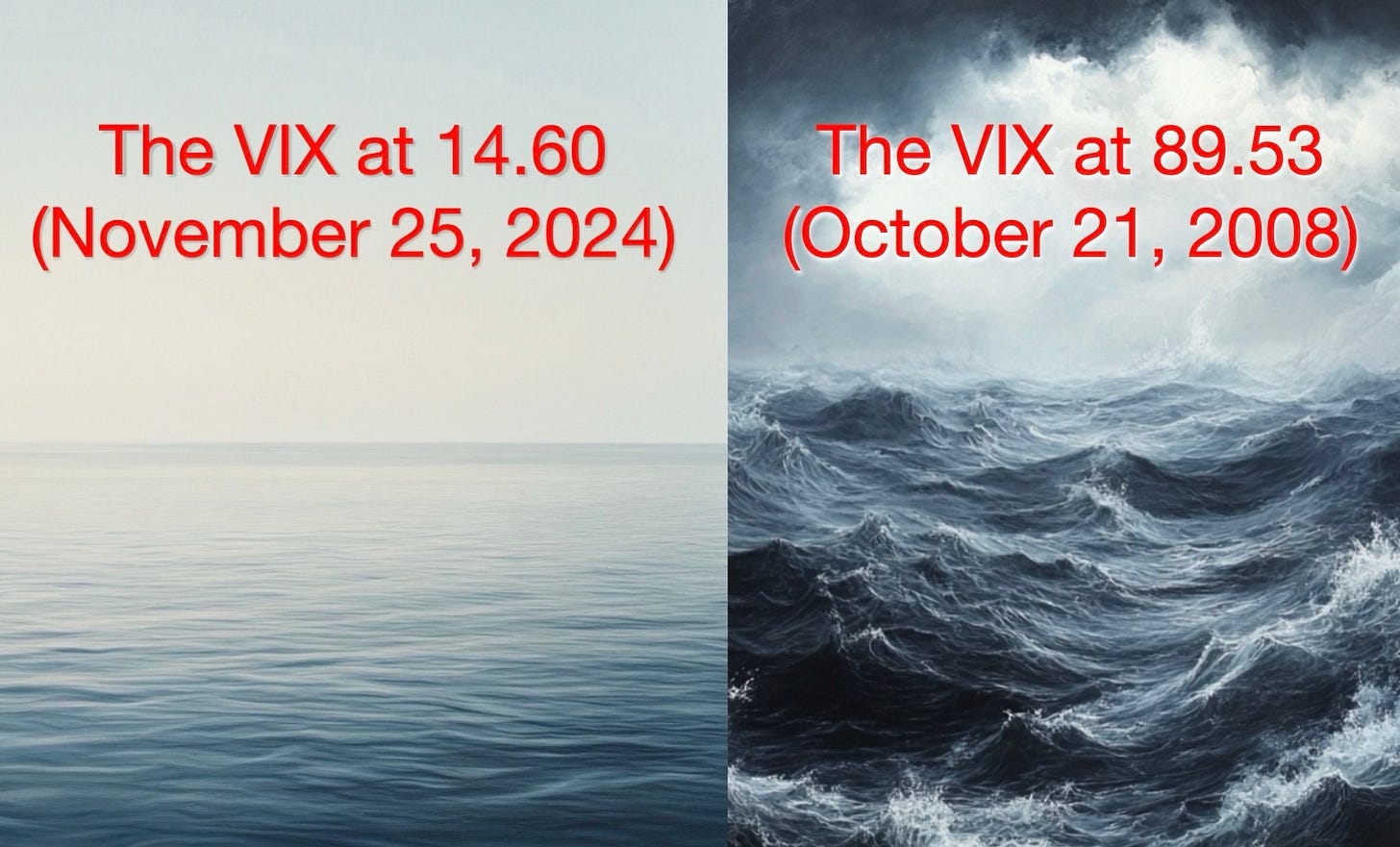

If the VIX is high, like when it hit its all-time high of 89.53 during 2008’s Great Financial Crisis, investors are bracing for a biblical-type storm. When it’s low, like it’s been of late, it’s smooth sailing ahead:

Some sophisticated investors are able to leverage this information to win big on the stock market. [Not me.]

I like to keep an eye on the VIX. Not to guide my investing decisions, but to gloat. Seeing its day-to-day fluctuations, and knowing that I’m side-stepping all this drama as an index-investor, gives me a sense of smugness and of validation. This is why I—and millions of other investors—decided to take the less crazy-making path of investing in broad-market ETFs in the first place.

VIX: An Indicator of Signlessness?

Rubber-necking and self-congratulation aside, I do have another use for the VIX: It is a wonderful indicator of the Buddhist concept of signlessness.

Signlessness, at its essence, is the notion that reality is not quite as it seems. What we perceive with our senses and how we conceptualize the world is not the ultimate reality. Just like, as the Zen parable goes, the finger pointing at the moon is not the moon itself.

We human beings love attaching labels or concepts to things around us: mom, car, dog, etc. These labels are just a loose approximation of the actual thing. Implicit in the label (or sign) is the idea that something is permanent and fixed. But everything is in a constant state of flux. What's “mom” one day is not the same “mom” the next day. Mom’s body replaces over 300 billion cells on a daily basis. And yet she’ll always be “mom.”

Signlessness is one of the three gates or doors of liberation (along with aimlessness and emptiness). Passing through these gates leads us to the truth of existence and liberates us from unnecessary suffering.

Signlessness is a tricky one to really embrace as it is such a function of the human mind to conceptualize the world around us. We conceptualize the world in order to make it more understandable and less scary.

Indicators don’t tell the whole story

Indicators like the VIX do the same thing with the stock market. They try to make it more understandable. Predictable even. Like we’re in control.

But that’s a delusion. The stock market is bafflingly complex and no single barometer is ever going to do the complexity justice.

As Ben Carlson says:

"...there’s never going to be one or two indicators that will tell you exactly how the future of the markets will unfold...This doesn’t mean that you should ignore these types of signals or theories, but it does make sense to take them all with a grain of salt...nothing is ever certain between expected and actual results in markets that have a huge human element involved."

- Ben Carlson, When Market Signals Look Too Good to be True

To continue Ben’s thought, I think indicators like the VIX are most useful when we understand that they present only a limited view of things. Only then can they be properly harnessed. Shirts can be lost when we put too much faith (or money) in them.

Fear & greed: Emotional indicators that we’re not seeing the whole story

Fear, greed, anger, sadness and other big emotions that come along with suffering are useful indicators.

They indicate that we’re fighting with reality in some way: denying the truth of our circumstances, deluding ourselves that we’re in control, raging against some perceived injustice, mistaking the finger for the moon, etc.

So the next time you face a challenging emotion, ask yourself:

What is this emotion trying to tell me?

How might my view of reality be causing me to suffer and feel this emotion?

Am I missing the whole story?

These aren’t easy questions to answer, but there’s value in simply contemplating them. At the least it might help to quell the emotions and be a little less at the beck and call of our amygdala.

CNN might think they measure investor fear and greed, but it’s only we, the investors, who can truly understand what these emotions are trying to tell us and how they can guide us to a richer, more peaceful life.

- The Buddh-i$h Investor

Takehome points:

Market indicators, like the VIX, provide only a limited perspective on the stock market. In using them to guide investing decisions, we must understand what their limitations are.

Signlessness is the Buddhist notion that things are not as they seem. We experience suffering (as greed, fear, etc.) when we deny the true nature of things.

Emotions are our indicators of how we’re relating to the truth of existence—either embracing its impermanence or denying it.

If you’re looking for more:

The Inner Peace Roadmap Course: A beautifully delivered crash course on signlessness and other core Buddhist topics. This is a great place to start if you’re curious about learning more.

Animal Spirits Podcast: My favourite investing podcast. They end every episode with their TV/movie/book recommendations. Ben and Michael are fun and smart.

I promise you, dear reader, that this is the only time that these phrases will ever appear on this Substack.

The Standard and Poor’s 500 or “S&P500” is an index of the 500 biggest publicly traded US companies (think Apple, NVIDIA, etc.). The S&P500 is heavily referenced by news agencies to give their audience a sense for “what the market did today.”

Don’t ask me how the VIX is calculated. This is not that kind of a Substack.

The VIX had its second biggest spike ever 2 days ago. Meanwhile the S&P500 is up nearly 1.5% today. This is good headline fodder, but doesn't change how I invest.

Came across this quote this morning (grabbed from MyDailyBuddha.com ) and thought it nicely captures the thrust of the post:

“In Buddhism, we work to illuminate the fundamental truth of our self-nature. When anger arises, it is pointing to something. Our anger is a clue to our underlying beliefs about ourselves. It can help to reveal our constructed sense of self-identity.”

– Jules Shuzen Harris, Zen teacher and psychotherapist (1940-2023)