Hand me that meditation cushion—and a $5 coffee too

Taking the 'Middle Way' with our personal finances

The Buddha was born into money. His father was a fabulously wealthy Indian king. Growing up, Siddhartha Gautama (the Buddha's birth name), wanted for nothing. His parents showered him in luxuries and sheltered him from the harsh realities of the world beyond the palace gates.

Naturally, he grew curious about what was out there. So he ventured out. What he found was illness, death, and infirmity—things he had never encountered before in his princely life. He decided that he wanted to see more and one day he just up and left, leaving behind his wife, parents, vast riches, and even a newly born child. He was in search for inner peace, the one thing his life of indulgence had not provided him.

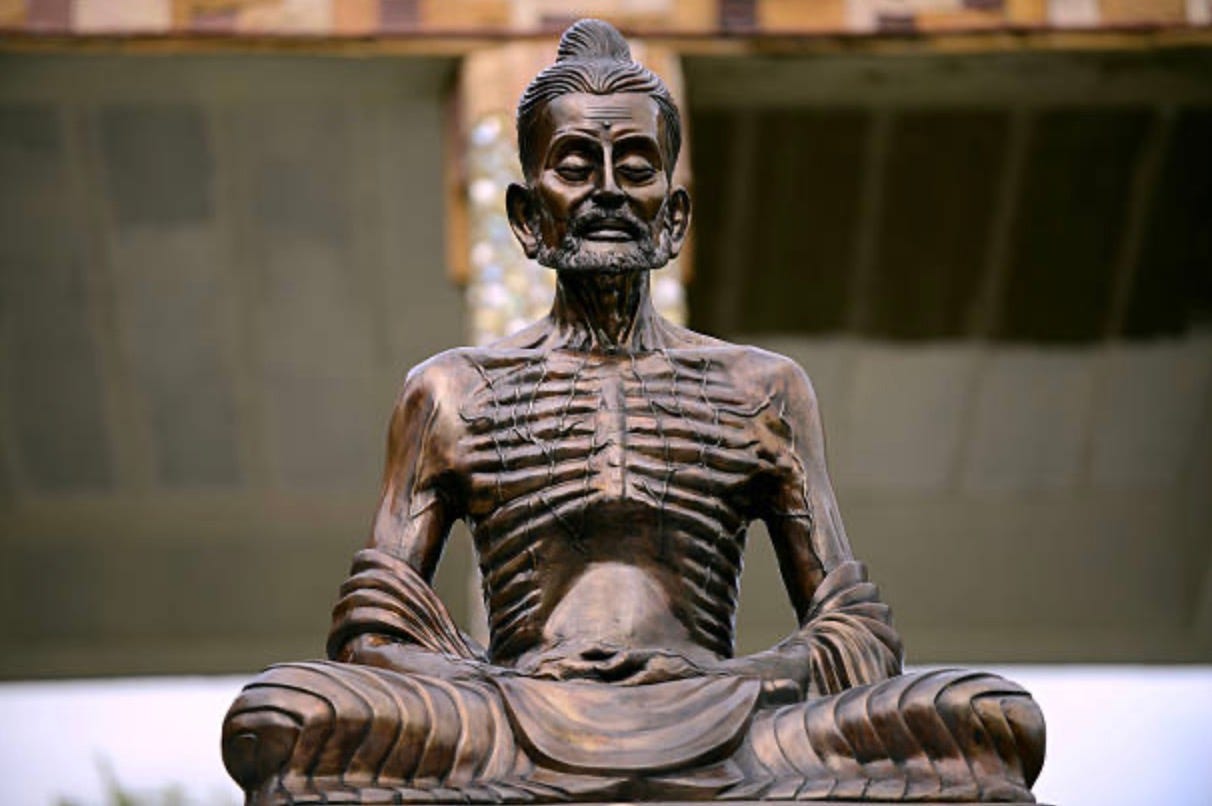

Buddha threw himself into a life of asceticism after encountering some traveling monks. He was so good at the ascetic life that these monks eventually became his followers…and he almost died from it.

He deprived himself of earthly pleasures, including food, to the point that he wasted away to nothing (see above). On the verge of death from starvation, he accepted an offering of rice milk from a young woman named Sujata. This food saved his life and woke him up to the fact that life had more to offer than deprivation and self-punishment.

He nourished himself back to health. He even allowed himself some comforts, like a meditation cushion. For years, he had meditated for hours a day without any kind of padding. [For anyone who's meditated for longer than five minutes on a cold, hard floor, you understand how necessary a cushion is.]

The Buddha's acceptance of the meditation cushion marked a shift in his spiritual journey.

He had landed on a "middle way" between the ascetic life and the more hedonistic one that he had enjoyed as a prince. He realized that peace and liberation from suffering lay not in either extreme, but somewhere in between. Not too hot, not too cold, but just right (to borrow an analogy from Goldilocks).1

The Buddha shared his notion of the “middle way” in his very first sermon (called the “Dhammacakkappavattana Sutta” - say that five times fast!) and used it as the foundation for the Noble 8-fold Path, the roadmap he provided us with to help reduce suffering in our lives.

The ‘middle way’ came to mind recently while reading articles about ‘lifestyle creep’ from two seasoned personal finance writers, Robb Engen (of Boomer & Echo) and Ben Carlson (of Animal Spirits, A Wealth of Common Sense, etc.). Both had similar messages:

"I decided it would be better to introduce some lifestyle creep now to make sure we could maximize our life enjoyment today, tomorrow, and throughout retirement...Don’t get me wrong, I’m still a saver at heart. But tomorrow is never promised."

"Lifestyle creep isn't always bad...If you're making more money over time you should be saving more but spending more too. There is nothing wrong with enjoying the fruits of your labor assuming you keep your savings rate relatively constant over time."

Their message of, "it's okay to enjoy yourself along the way", really resonated with me. In middle age, I’ve chilled out a bit when it comes to spending money. I don't sweat paying five bucks for a coffee or occasionally getting Uber Eats anymore. [But I still draw the line at $16 cans of beer at sporting events and doggie toy subscriptions. *shudders*]

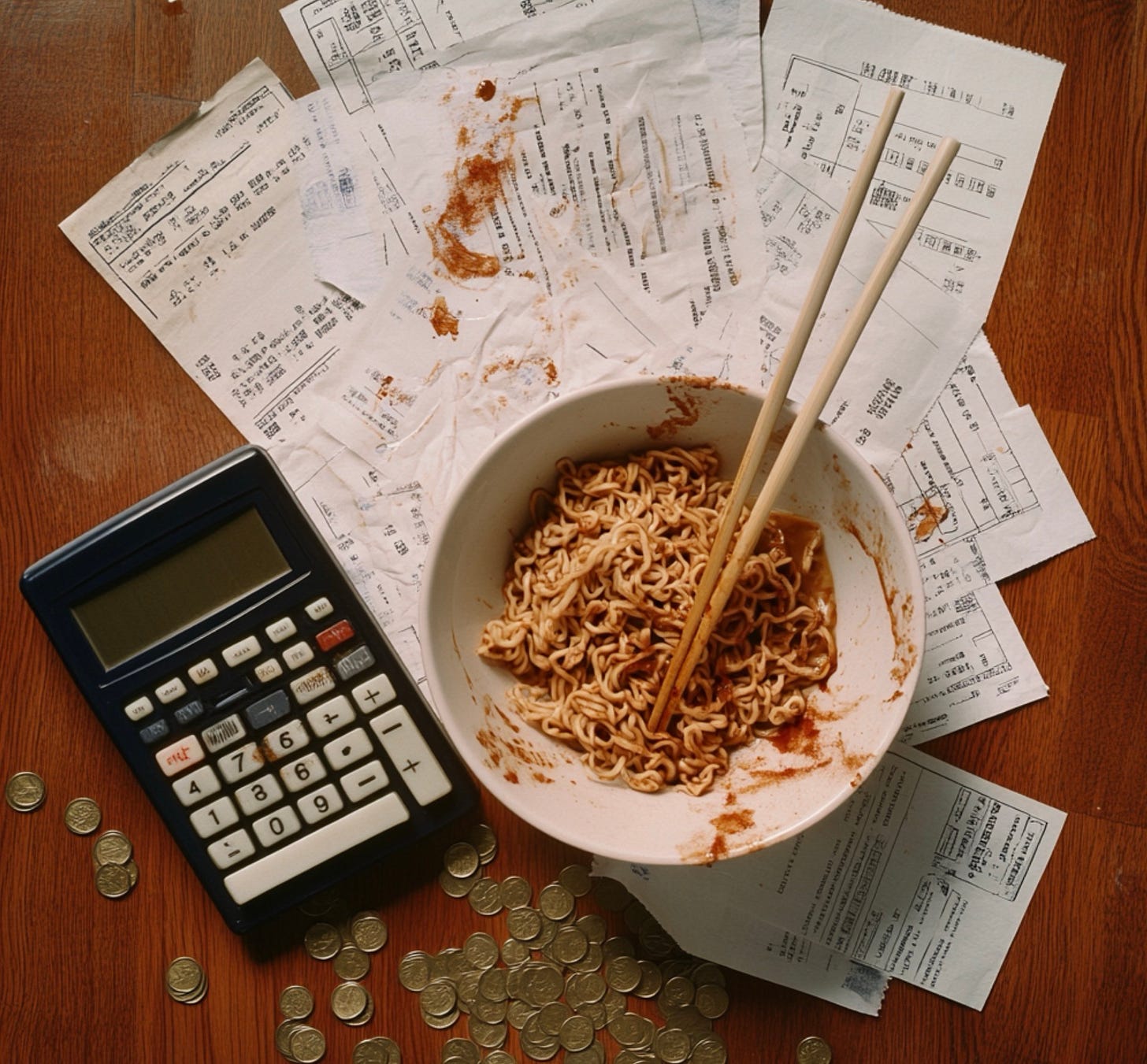

I’ve never been one for extreme frugality—like those ascetic FIRE2 folks eating ramen noodles for years to pay their mortgage off before age 30—but there was a time when I was a bit over-zealous with saving for retirement. Foregoing fun now for fun later.

What I—like my fellow 40-somethings Ben and Robb—have realized is that there might not be a later.

This notion was crystallized in a book all three of us have read: "Die With Zero” by Bill Perkins. Perkins encourages us to have fun while we can and to spend, donate and bequeath all of our money before we kick the bucket. He’s not telling us to blow all of our savings on a week-long cocaine bender in Las Vegas. His message—like Ben and Robb’s—is to take a ‘middle way’: have fun and be generous, but also make sure you’ve got enough to retire on (and not a penny more).

Everyone’s middle way is going to look different depending on your circumstances.

For Robb, it’s:

“…saving about 20% of our personal income (TFSAs and RESP), setting aside 20% for taxes (paid in quarterly instalments), spending 20% on total housing costs, 20% on daily living (groceries, transportation, health, kids’ activities, etc.), and 20% on travel and guilt free spending.” (excerpted from here)

For Ben, it’s:

“maxing out my retirement accounts, saving for the kids in their 529 plans [US equivalent of Canada’s RESP], keeping enough liquid reserves for unexpected expenses and putting money into my taxable brokerage accounts.” (excerpted from here)

And owning a lake house.

I have similar savings goals as Robb and Ben and my own splurges too: sushi lunch once a week, subscribing to the Criterion Collection and buying books without a second thought.

For the Buddha, it was using a meditation cushion and turning his back on “self-mortification” practices.

What’s your ‘middle way’ to personal and financial peace?

- The Buddh-i$h Investor

Takehome points:

The Buddha found a “middle way” to inner peace between the extremes of asceticism and indulgence.

We can find our own middle way when it comes to our personal finances—by saving for the future, but having fun along the way.

If you’re looking for more:

Nick Maggiulli on a kind of FIRE I could get behind: Fat FIRE

The story of Buddha’s enlightenment as told by Buddhist teacher Shell Fischer

The Buddha himself explained the ‘middle way’ by likening it to the tuning of a lute, as described here.

FIRE = Financial Independence, Retire Early