How I Finally Sold My Losers (& Found My Financial Golden Buddha)

On cognitive bias, financial planning, kalyanamitra and achieving your financial goals

I got this little pep-talk from my new financial planner in an email the other day:

I had lamented to him about my struggles to sell a couple of losing bond ETFs cluttering up my portfolio.

Bond ETFs bundle together a whole bunch of bonds (so the investor doesn’t have to buy them individually). There are many types of bond funds. ZFL and XLB, the two bond ETFs I couldn’t bring myself to sell, hold bonds typically >10 years in duration issued by government and the most trustworthy of corporations. Other bond funds hold bonds of shorter duration, different geographies, and sometimes issued by less reliable companies. Investors use bonds to smooth out the volatile spikes in their portfolio and to generate some passive income.

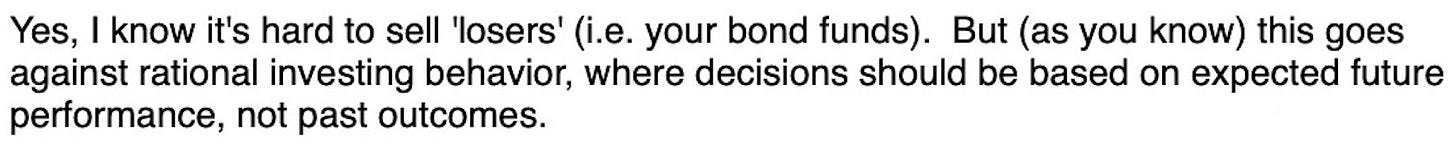

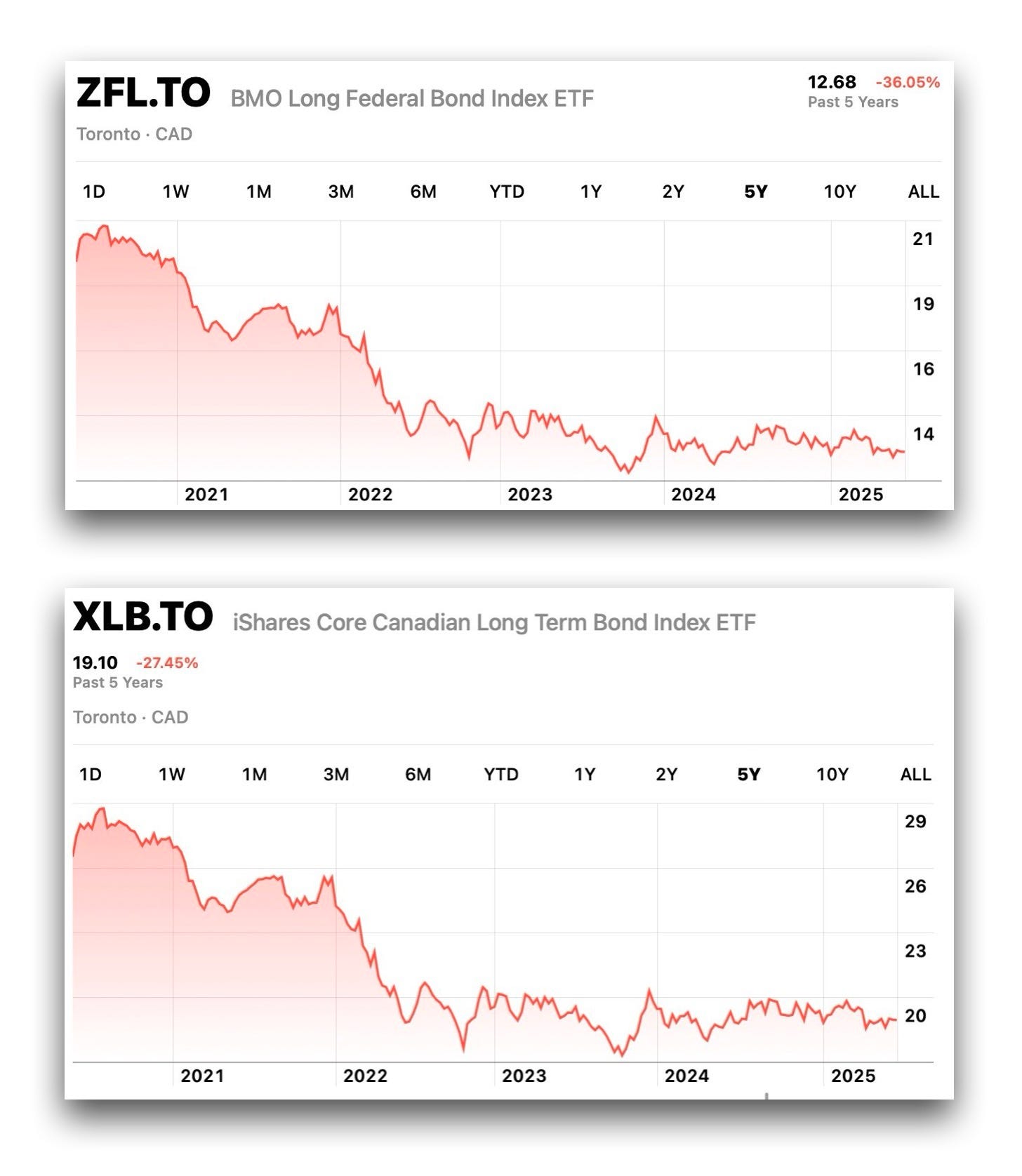

Anyway, here’s what ZFL and XLB have done over the past few years—not great:

Both down well over 25% since they were first bought years ago in one of my wife’s investing accounts by a well-meaning family member.

Bonds have had a rough go in the past few years with interest rate hikes by central banks around the world1. The charts above for ZFL and XLB clearly show the moment when bonds fell off a cliff in 2022. And they haven’t done much since.

Now I’m not saying that bonds are done. They’ll probably have their day again.

And I’m not saying that there’s no place for bonds in a portfolio.

But just not XLB and ZFL in my portfolio.

Why it’s so hard to sell losers

Lots of reasons come to mind for why I should’ve ditched XLB and ZFL—stream-lining my portfolio, reinvesting the money elsewhere, and not having to go through the cognitive song and dance of “should I stay or should I go?” every time I saw them taunting me in my portfolio.

But I couldn’t bring myself to ditch the losers for years.

I was firmly in the grip of the ‘disposition effect,’ a cognitive bias that drives investors to hold onto losing investments too long (while selling winning investments too early).

Loss aversion is at the heart of the disposition effect. We humans don’t like to lose. It’s painful. It’s humbling.

So we avoid losses. We hold on to the losers in our portfolios in hope that they might one day break even. And maybe they will bounce back. But waiting comes at a cost. Odean (1998) estimated that the disposition effect can cause a portfolio to lose in the ballpark of 4% per year. Not to mention the time and sleep lost over trying to figure out what to do with the losers.

How a financial planner is helping us

I finally ditched XLB and ZFL after the gentle kick in the butt from my financial planner (see above).

He didn’t coerce me into selling them. He merely reminded me of what my bigger investment goals were—simplicity, broad diversification—and left it to me to decide whether I thought XLB and ZFL were in line with these goals. They’re not. So I sold them.

Helping my wife and me see the forest for the trees has been our planner’s greatest gift to us. He’s helped us bring our goals, values and dreams into focus. They’ve been there all along, but just not clearly defined.

Said another way: Our planner has helped us get in touch with our inner financial Buddha-nature.

Finding our inner golden Buddha

Buddha-nature is the inherent potential for enlightenment within all beings. We all have the ability to take steps towards reducing the suffering that we experience and cause those around us.

We all have a golden buddha in us waiting to be let out.

Like this one—the Phra Phuttha Maha Suwanna Patimako statue in Bangkok, Thailand:

This golden buddha’s own golden inner buddha wasn’t revealed until it was damaged in a move in 1954. Centuries before, it had been covered in clay to conceal its true, quite valuable2 nature from potential thieves3. The clay got chipped away when a crane tried to lift it up to transport it to a new monastery. The monks were flabbergasted. What had appeared to be an ordinary clay statue turned out to be a solid-gold rendering of the Buddha.

I often bring this story of the golden buddha to mind when I beat myself up for something I did or didn’t do. Despite these regrettable acts and personality flaws, I remind myself that, at my core, lives a golden buddha. To reveal this buddha, I have to peel away the outer layers of clay: my delusions, ignorance, habitual reactivity, and unskillful actions.

I have been helped in this process by my family, friends and spiritual counsel. I haven’t had a formal guru, but I’ve had many great teachers along the way—Noah Rasheta, Pema Chödrön, Thích Nhất Hạnh, Shell Fisher, and people in my close circle like my wife and meditation buddies.

I have an “admirable friendship” or kalyanamitra with these people. They are the financial planners in my spiritual life. They help me live in line with my true Buddha-nature in the same way a financial planner helps guide us to our financial dreams.

The Buddha extolled the centrality of kalyanamitra to the spiritual life:

“Admirable friendship, admirable companionship, admirable camaraderie is actually the whole of the holy life. When a monk has admirable people as friends, companions, & comrades, he can be expected to develop & pursue [the path to enlightenment]”

Your trusted financial kalyanamitra

My wife and I have forged an “admirable friendship” with our new financial planner. We genuinely feel he is helping us articulate and achieve our financial goals without foisting his own expectations/values/biases on us.

Do you have a financial kalyanamitra? Someone you can have a frank and open discussion with about your financial questions and concerns? Someone who can help you move toward your financial goals? A parent? Your spouse? Your accountant?

If you can’t think of anyone, find someone. Maybe even a financial planner like we did.

Financial planners come in many shapes and sizes, so there’s probably someone out there for you. Our planner is “advice-only,” meaning that he provides only recommendations and leaves it to us to execute them. Other planners, like PWL Capital for example, will completely take the reins of your finances and invest for you if you don’t have the time or inclination to do it yourself. Some planners, like those employed by big banks, are probably best avoided.

If you’re interested in the financial planner route, I’ve included some links below to help you get started.

Talking about your financial future with trusted confidantes will make it seem less unattainable and nebulous. You won’t end up holding duds like XLB and ZFL for way too long. Or worrying about your finances more or less than you ought to. Or not charting the kind of future you want for yourself.

Establishing a kalyanamitra with our financial planner in recent months has been transformative for my wife and I.

With his help, chips of clay, like XLB and ZFL, are starting to fall away, revealing our hopes, dreams and inner financial golden Buddha.

- The Buddh-i$h Investor

Take home points:

The disposition effect: Investors may fall prey to the cognitive bias of the ‘disposition effect,’ holding on to losers for too long. Financial advice from a trusted source can help overcome this and other biases.

The value of financial guidance: Working with a financial planner can help clarify long-term goals and provide the gentle push needed to make difficult decisions, much like how spiritual teachers help reveal one's "inner golden Buddha" by chipping away unhelpful patterns.

If you’re looking for more:

A pretty good guide to picking a financial advisor from the Government of Canada.

And another guide to selecting a financial planner from MoneySense

A directory of advice-only financial advisors in Canada compiled by financial planning firm Steadyhand.

If you’d like to learn more about the inverse relationship between interest rates and bond prices, go here. Definitely won’t be discussing it on these pages. ;-)

The Golden Buddha statue is estimated to be worth upwards of $250 million US dollars, so can understand the paranoia that someone might want to steal it.

Good luck stealing it though. It weighs 5.5 tonnes and is located on the 4th floor of a temple in the busy Chinatown area of Bangkok. [Sounds like a setup for an Oceans Eleven heist.]