Pain x Resistance = Suffering

The only investing formula you'll ever need to know

A rite of passage for many new investors is to read Benjamin Graham’s classic The Intelligent Investor:

I bought a copy way back when, but never finished it.

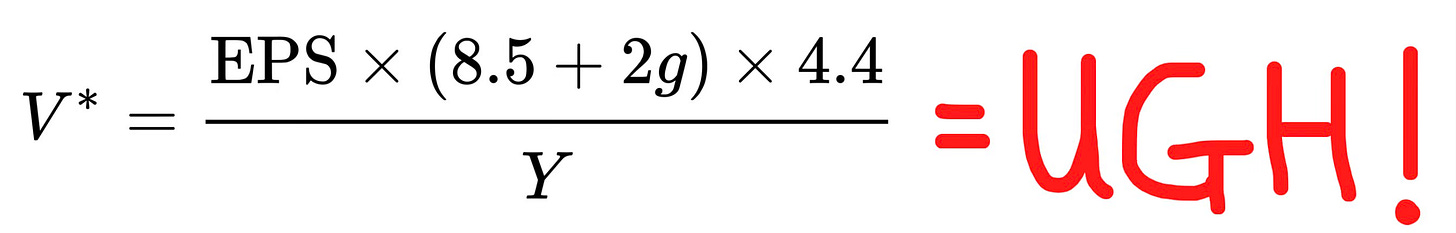

I plowed my way through the first few chapters, but then encountered this impassable roadblock—the Benjamin Graham formula:

Value investors like Graham and his student Warren Buffett use formulas like this to estimate how much a company is actually worth compared to what the stock market currently values it as. If a company is “under-valued” by the stock market, then this is a buying opportunity. The Oracle of Omaha and his company Berkshire Hathaway (BRK) have made billions following this approach:

As math equations go, the BGF isn’t even that intimidating. But it was enough to scare me, skittish new investor that I was, away from the world of value investing.

And, after 15 years of investing, I still avoid math formulas like the plague.

I don’t think I’m missing much1.

Warren Buffett has warned against them:

“Beware of geeks bearing formulas.”

- Warren Buffett, in 2008 letter to BRK shareholders

And even the venerable Benjamin Graham formula has its detractors. Graham himself cautioned investors against putting too much stock in it:

Warning: This material is supplied for illustrative purposes only...Let the reader not be mislead into thinking that such projections have any high degree of reliability…

- Benjamin Graham, footnote in The Intelligent Investor

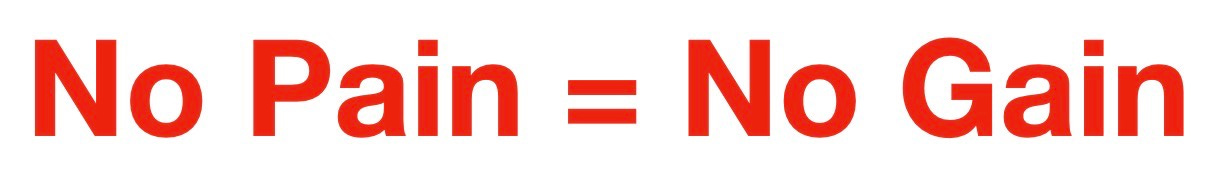

That said, there is one formula that I have found use for in investing—and in the rest of my life:

This one comes courtesy of a meditation guru2 not an investing wiz.

It gets at the very heart of the Buddha’s teachings much like Einstein’s E = mc^2 boils down the nature of the universe.

Let’s take a closer look:

Pain = Unpleasant stuff that happens to us (e.g., bear markets, illness, death, divorce). Pain is unavoidable in life.

Suffering = How we hurt in response to pain (e.g., frustration, despair, self-loathing). Suffering is potentially avoidable.

Resistance = How we try to deny or avoid pain and, in turn, cause ourselves more suffering (e.g., selling low, road rage)

Here’s an investing example to illustrate:

In this case, “pain” is your portfolio ‘getting a haircut’ with a market dip. You didn’t ask for this, but it’s happening.

The loss triggers an overwhelming ‘loss aversion’ response which prompts you to sell your holdings to protect your nest egg from further damage. Rather than just ‘sit with the pain’ and wait for it to pass, you felt compelled to act—and do something to push back against or resist the pain you’re experiencing.

Selling low turns your on-paper losses into real-world losses. You just destroyed wealth. You suffer. And this suffering keeps piling up as you see the market bounce back the very next day and you tell yourself “I’m a terrible investor” (and probably worse).

When it comes to investing, there are lots of ways we resist or try to side-step pain:

Avoid risk altogether: Some folks prefer to “invest” (if it can be called that) strictly in low/no-risk products like GICs and money market funds. It’s win-win as they see it: assured returns and no risk of painful losses. But there’s still pain to this approach, it’s just not as obvious. It comes in the forms of lower long-term investing returns and nagging thoughts of FOMO (“what else could I be investing in?”). Risk is inescapable.

Speculation and trendy investing: I think of speculative trading (e.g., options) and trend following (e.g., meme stocks) as the investing equivalents of morphine. They numb investors to the pain of investing by promising fantastical returns and bolstering delusions of over-confidence and invincibility. But the pain eventually bleeds through, requiring bigger and bigger hits and ever-escalating risky behaviour, until the inevitable overdose or withdrawal. Numbing pain doesn’t make it go away.

Trusting ‘geeks with formulas’ and

punditscharlatans: In the complex world of investing, it can be tempting to put our trust in people who, on the surface, look like they know what they’re talking about and are offering “a cure for all that ails ya.” These charlatans take advantage of our overriding human desire for certainty and deathly fear of pain. They can’t predict the future any better than you can. And they are just as subject to pain as you are.

What all these approaches have in common is that they are futile attempts to resist or deny pain.

But denying pain doesn’t make it go away. It actually makes us suffer more. Resistance is directly proportional to suffering. The more you push, the more you’ll hurt.

So what do we do?

Do the math. Pain is a constant, so the only variable we can work with is resistance.

This is easier said than done. Avoiding pain is hard-wired into us as humans. We fight it with everything we’ve got.

The Buddha understood this, and he provided us with an exit strategy out of the fight: be present with the pain through mindfulness.

Pema Chödrön, as usual, captures this idea beautifully:

“Instead of asking ourselves, 'How can I find security and happiness?' we could ask ourselves, 'Can I touch the center of my pain? Can I sit with suffering, both yours and mine, without trying to make it go away? Can I stay present to the ache of loss or disgrace—disappointment in all its many forms—and let it open me?' This is the trick.”

- Pema Chödrön

This is indeed the trick, but it’s not a quick fix. According to Pema, getting comfortable with pain proceeds “bit by bit, inch by inch, small step by small step.”

Wealth is built in the same way—one dollar at a time—with a lot of pain felt along the way: Great Financial Crisis, pandemic crash, Black Monday, Great Depression, take your pick.

It’s only through experiencing pain—and really getting to know it—that we can liberate ourselves from suffering and live richer lives.

Which brings to mind the only other formula I’ve found useful in my investing life over the years:

- The Buddh-i$h Investor

Takehome points:

Pain is unavoidable in life. Suffering can be optional.

Denying pain doesn’t make it go away. It actually makes us suffer more. Investors use many ill-fated strategies to avoid pain (e.g., speculation, no-risk investing).

Accepting pain and getting to know it through mindfulness is the path to less suffering in our lives.

If you’re looking for more:

Pema Chodron’s dharma talk Change Your Heart Towards Pain on how to get more okay with pain

An interesting discussion of the Benjamin Graham formula from GrahamValue.com

This is not to say that math formulas aren’t helpful to other investors. To each their own.

The equation has been attributed to renowned American meditation teacher Shinzen Young, but hard to say if it originated with him.