The 'Being There' Portfolio

The deceptive simplicity of passive index investing

I recently re-watched the 1979 satirical movie Being There while stuck on a long plane ride.

When I first watched it 15+ years ago, Being There stirred up something in me that I couldn’t quite put my finger on.

Turns out that “something” was a nascent, even subconscious interest in Buddhism.

Years on and a little farther down the path to enlightenment, I now can’t help but see all the Buddhism that permeates Being There: present-moment awareness, equanimity, impermanence, beginners mind, and more.

Chief among these is the concept of maya, which refers to the illusory nature of our perceived reality. Maya gets at the idea that reality doesn't exist in the way we typically perceive it. Our eyes deceive us. Our brains create a simulacrum of the world around us based on the limitations of our senses and biases. The delusion of maya causes us great suffering. Seeing reality as it truly is reduces our suffering.

Idiot Buddha

Chance the Gardener is the idiot hero of Being There. He was played by Peter Sellers in one of his final film roles—and probably his greatest. [Yes, even greater than Inspector Jacques Clouseau in the Pink Panther movies.]

Chance is a simpleton. He can't read or write. He is naive in the ways of the world. Childlike.

Television is Chance's only education on the world outside the walls of the rich man's mansion in which he happens to live and work as a gardener.

He spends his days flipping through channels and imitating what he sees on the screen.

Until one day he has to leave the mansion and go out into the world, dapperly dressed in a 3-piece suit and bowler hat gifted to him by his previous benefactor.

Hilarity ensues, including a famous scene in which he tries, using a remote control he took from his old home, to change the channel on a street gang accosting him.

Before long, Chance falls ass-backwards into success. He meets Shirley MacLaine's character, moves into her mansion and starts rubbing shoulders with the fabulously wealthy and politically powerful. He even acquires the rather WASP-y sounding moniker "Chauncey Gardiner" when "Chance the Gardener" is misheard.

The true hilarity of the movie rests with how people react to Chance, who looks the part of a powerful, wealthy man, but speaks in vague cliches and gardening analogies.

Chance's platitudes are mistaken for profundity. The President of the US even quotes him in a speech.

Chance is the living embodiment of maya.

Chauncey, not Chance: Maya and cognitive dissonance

Chance evokes powerful cognitive dissonance in the people he meets. How could someone so dapperly dressed and perfectly mannered say anything that wasn’t thoughtful or profound?

He can't possibly mean the facile things that he says. There has to be a deeper meaning to it.

At stake for people is their cherished hold on reality. People's minds would explode if Chance were revealed for what he truly is.

Chance can't be anything but the WASP-y man that he appears to be. He has to be Chauncey, not Chance.

And so they go along with the delusion. They buy into the narrative. They fall prey to maya. As we all do.

Passive investing: The Chauncey Gardner of investing

We humans are experts in seeing what we want to see. We actively seek out information that confirms our biases. We assume that we hold the absolute truth and that everyone else is wrong.

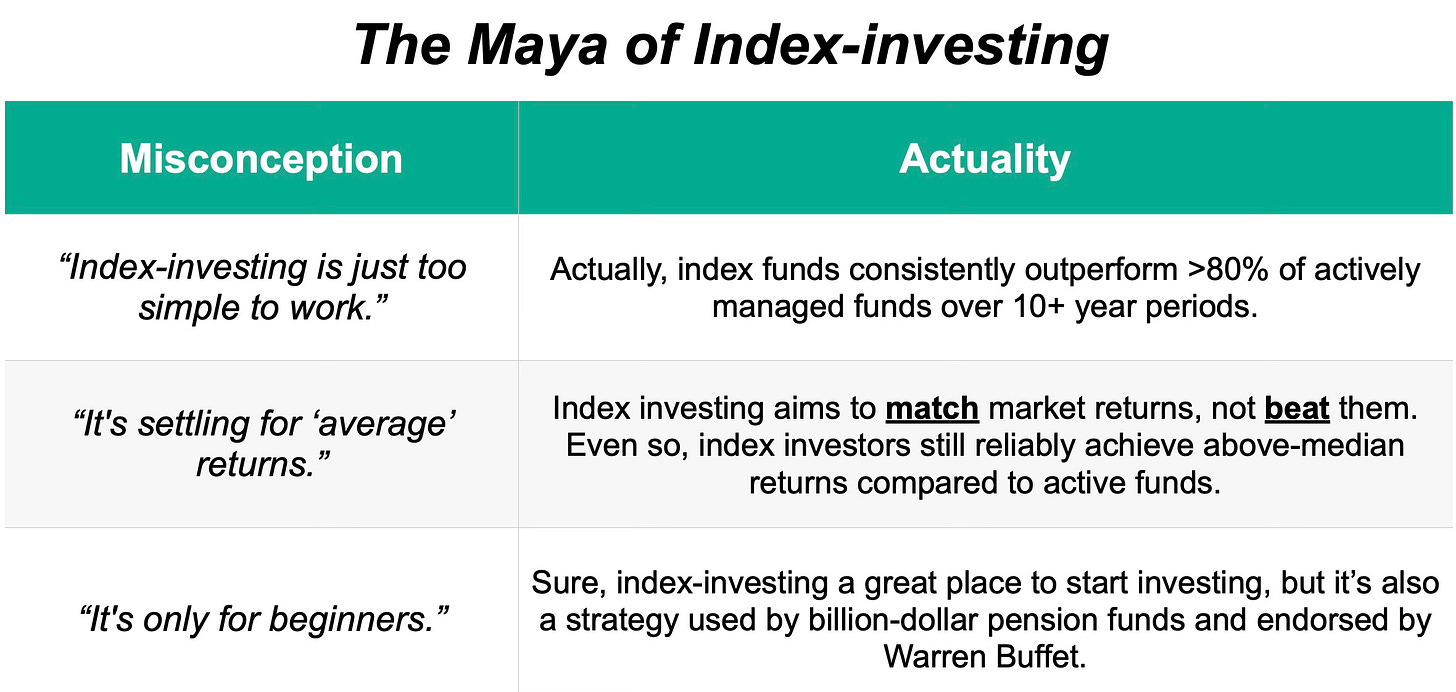

Passive index investing is the Chauncey Gardiner of the investing world. There are so many misconceptions that hover around it1:

Index funds are not what they appear.

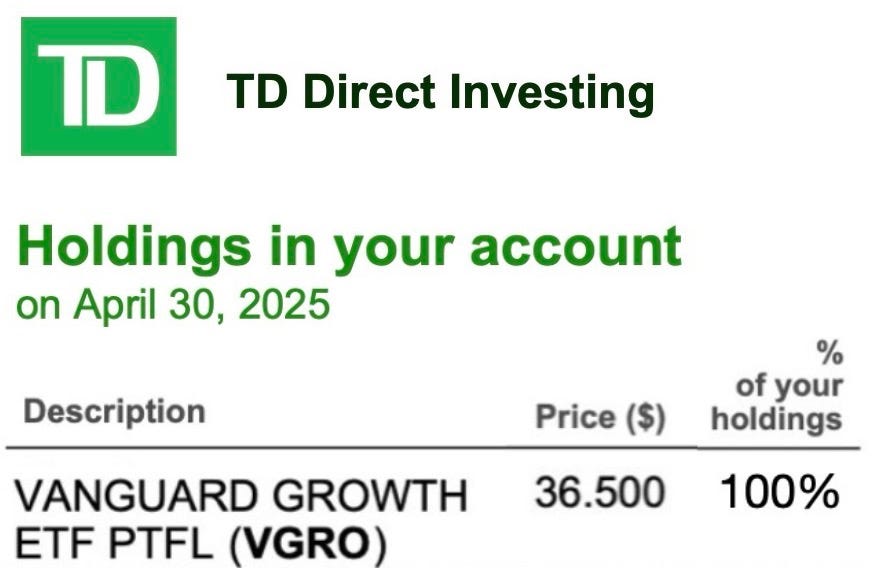

Take a look in any passive investor's portfolio, and you might see something like this:

Wait, just one holding? Where's the rest of the portfolio? Where's the Apple, Tesla, NVIDIA, triple-leveraged ETFs, options, etc.?

But it's really that simple. One fund can do the trick. One passive fund can out-perform the vast, vast majority of active investors2.

One fund can contain the whole stock market.

Don't let the simplicity fool you. Index funds are as complex as Chauncey Gardiner is simple (despite outward appearances).

The Being There Portfolio

Deceptive simplicity is at the heart of the Being There Portfolio. It doesn't look like much on first glance, but scratch the surface and its true complex nature is revealed.

How do you get your own Being There portfolio?

Just follow these two simple guidelines:

1) Keep the number of holdings in your portfolio in the single digits—even just one.

2) Buy low-cost, broad-market, index-tracking funds and stick with them.

"But which funds?" you ask.

Probably the best bet for busy retail investors like you and me are what are called "all-in-one" or "portfolio" ETFs. These products bundle together thousands of stocks and bonds from around the world. Buy a single fund, and you are instantly diversified. How simple is that?

Let's take VGRO as an example.3

VGRO is one of Vanguard's suite of portfolio funds.

One single share of VGRO exposes you to ~13,400 stocks and ~19,400 bonds spread across the US, Canada, and the rest of the world.

It works out to an allocation of 80% stocks (or "equities” as they’re called) and 20% bonds (or "fixed income")4.

And all this for a relatively modest MER fee of 0.24%.

You could open up an investment account, buy some VGRO (or one of the many other similar products out there), and—BOOM!—you've got your own Being There portfolio. So simple that Chance the Gardener could create it, but complex enough to be a portfolio befitting of Chauncey Gardiner.

Don’t let maya be the reason that you miss out on a simple (but, on second glance, dazzlingly complex) path to building a richer life.

The Buddh-i$h Investor

Take home points:

The Buddhist notion of maya gets at that reality doesn't exist in the way we typically perceive it. The misperception of reality causes us to suffer.

There are many misconceptions about index investing, in particular that it is “too simple” to be effective. In actuality, it is only deceptively simple.

The simplistic Being There portfolio looks beyond the misconceptions of index investing and, for retail investors like you and me, is a surer path to wealth than more complex investing strategies.

If you’re looking for more:

A list of some of the Chance-approved all-in-one ETFs available in Canada (courtesy of SavvyNewCanadians.com)

The much-discussed final scene of Being There:

I'd wager to say that many of the misconceptions of index investing are propagated by an investing industry that loses money on them. They'd rather have you filling their pockets with fees from day-trading, options, pricey mutual funds, etc.

Each year Morningside publishes its US Active/Passive Barometer Report which beats the drum that passive funds beat the crap out of their active counterparts over long time horizons.

I own VGRO, but this is in no way an endorsement. I could just as easily own any of the other comparable funds out there (from BMO, Horizons, Vanguard, etc.). Do your own research and make your own decisions.

This is an allocation I'm okay with, but some investors would say it's too risky or not risky enough. If you want to get a sense of where you fall on the risk spectrum, try taking this free questionnaire from Vanguard.