The Market's Monkey Mind

Maintaining focus in the age of firehose-drinking

Trading on the New York Stock Exchange (NYSE) starts each day with the clang of the Opening Bell at 9:30AM EST. The day ends with the Closing Bell at 4:00 PM.

In between bells, there’s a dizzying amount of activity:

And that’s just a typical day. On busy days, like we’ve seen with the recent US “tariff tantrum,” trading volumes can be 2 to 3 times higher. And on terrifying days, like in the early days of the pandemic, volumes can be much, much higher. February 28th, 2020, for instance, saw 7,400,000,000 shares traded on the NYSE with a dollar value of $330,000,000,000. Just in one day.

The human brain does not intuitively grasp numbers of this magnitude. We’re pretty good in the 1 to 1,000 range, but, once we get to the millions, billions and beyond, we need help from analogies or visualizations (like the ones here) to understand.

This ‘number numbness’ as it’s been called1 is just another reason why the stock market will forever be beyond our comprehension.

But the numbers are just part of the story. Even more complexity is layered on with all the stories that are told about the market by BNN pundits, finfluencers (not a typo), and your uncle Ralph: why the markets went down, why they went up, why you should buy now, why you should sell, etc.

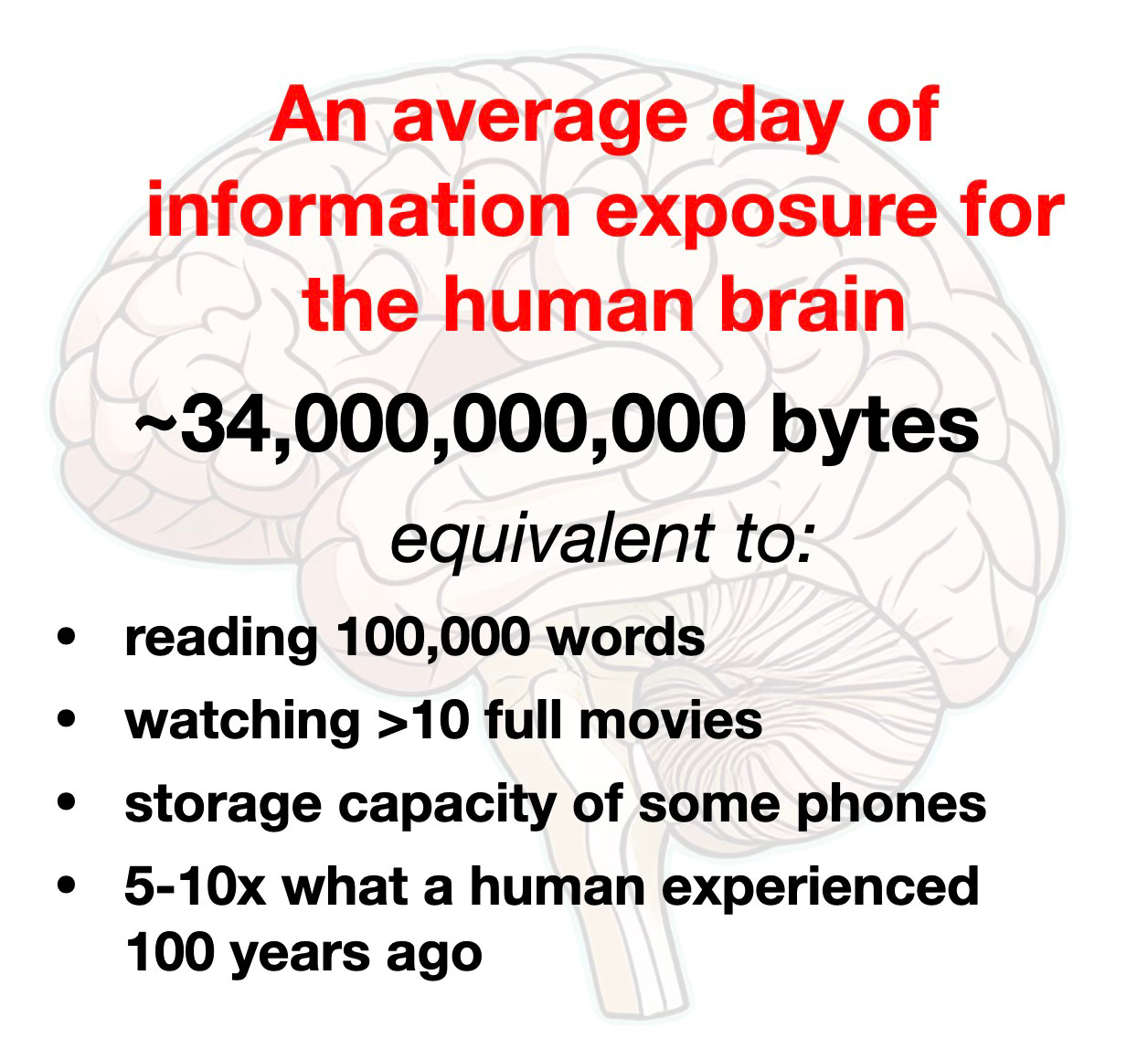

Firehose-drinking and Papañca

To pay close attention to the stock market is to ‘drink from a firehose.’ It’s information overload. Firehose-drinking is the name of the game these days. You and I, as average humans living today, are exposed to approximately 34,000,000,000 bytes (or 34 gigabytes) of information daily2. In more concrete terms:

How do we manage to have a single cogent thought or even get out of bed in the face of this barrage of information?

By filtering.

Only approximately 0.0005% of the information we’re exposed to actually makes it to a conscious level in our brain3.

But even that tiny sliver is still a lot of information.

Try observing your brain at work in meditation some time. Plunk down on the meditation cushion with the goal of observing your breath. Within mere milliseconds your brain will probably detour into thinking about what to have for dinner, where you left the keys, what you’ll get your spouse for their birthday, and so on.

Eventually you will make it back to your breath for a few milliseconds, and then your brain will be off on another tangent. Bouncing from one thought to the next to the next like a monkey swinging from vine to vine.

This is our “monkey mind” at work. The Pali term papañca (pronounced “pah-PAHN-chah”) describes similar mental agitation or restlessness.

Papañca helped keep us alive on the savannah hundreds of thousands of years ago. But these days it’s on overdrive and, collectively, we’re feeling the effects of it—unease, anxiety, isolation, distraction, burn-out, insomnia, you name it. Our brain’s filter continues to do its work, but it’s still not enough.

We need focus.

Watching the monkey mind at work

In meditation, we observe our monkey mind in action. We see that it is the brain’s natural tendency to keep churning out thoughts. Just like it’s the heart’s job to churn out blood. And the liver’s job to produce bile.

But just because our brains think it, doesn’t mean we have to pay attention. We can teach ourselves through meditation and mindfulness to just sit back and let our brains do their thing. We can train ourselves to focus on our breath instead of being dragged along on an endless stream of thoughts. Easier said than done, but with practice, it does get easier.

The Market’s got its own monkey mind: innumerable transactions, trillions of dollars changing hands, nauseating ups and downs, 24/7 market banner on social media, and so on.

It’s hard to ignore all this market noise. Even as a passive investor, I still check the markets a few times a day and review my portfolio at least once. I find myself easily drawn to click-baity articles, which further fuel my own tendency to overreact. If left unchecked, this cycle has led to some regrettable decisions.

How to deal with the Market’s Monkey Mind

So, where do we put our focus when faced with the Market’s monkey mind? What is our port in the papañca storm?

The answers to these questions differ for each of us.

When papañca’s leading me down the garden path (toward a decision I’ll regret later), I steady myself by focusing on:

My investment plan, which I summed up here. I can’t count the number of times I’ve referred back to this manifesto to re-centre myself.

My financial goals. I remind myself of the bigger picture. I don’t invest to invest; I invest to fund a better future for myself, my family and the world we live in. Does the investment I’m consdering serve this larger goal?

What the research says. Investors who spend less time trading, portfolio-gazing and generally obsessing over the stock market tend to outperform those who trade more often4.

And when I really feel the tug, I put my focus somewhere else entirely. I step away from my portfolio and spend time with loved ones and doing things I love to do.

The Market’s just going to keep doing its thing, but that doesn’t mean I have to go along for the ride.

Next Monday morning, when the NYSE’s opening bell rings at 9:30AM, think of it as a meditation chime to ‘go back to your breath’ financially instead of grabbing for the next vine along with the Market’s monkey mind.

- The Buddh-i$h Investor

Take home points:

The stock market generates overwhelming information overload - With billions of shares and hundreds of billions of dollars traded daily, plus constant commentary from pundits and "finfluencers," the market creates a "firehose" of information that our brains struggle to process meaningfully.

This mirrors our natural "monkey mind" tendency - Just as our brains naturally jump from thought to thought, the market has its own restless energy with constant transactions, price movements, and narratives.

The solution is mindful focus on what matters - Rather than getting caught up in daily market noise, investors should anchor themselves by focusing on their long-term investment plan, financial goals, and research showing that less frequent trading typically leads to better outcomes.

If you’re looking for more:

This is a meditation I keep coming back to as I get more acquainted with my own ‘monkey mind’:

The inimitable Shell Fischer’s dharma talk on papañca and the ‘monkey mind’:

The earliest reference to ‘number numbness’ I could track down:

Hofstadter, Douglas R. "Number Numbness, or Why Innumeracy May Be Just as Dangerous as Illiteracy." Scientific American 246.5 (1982): 20-34.

This rough estimate dates from 2012, so it’s probably safe to say we’re exposed to a lot more these days with the advent of smart phones and social media. Here are a couple of references I pulled the stat from:

Heim, Sabine, and Andreas Keil. "Too much information, too little time: How the brain separates important from unimportant things in our fast-paced media world." Frontiers for Young Minds 5.1 (2017).

Bohn, Roger, and James E. Short. "Info capacity| measuring consumer information." International Journal of Communication 6 (2012): 21.

A number I borrowed from Timothy Wilson’s book ‘Strangers to Ourselves’ (via James Clear)

The seminal study is Barber and Odean's "Trading Is Hazardous to Your Wealth" (2000), which found that the most active traders underperformed the market by about 6.5% annually after costs, while less active investors did much better.