The sky falls, the Market rises

Investing and kindness as acts of faith

We're living in anxious times. I hear it in the voices of my friends, family and neighbours. I lie in bed at night worrying about where all this is going. Maybe you do too.

The world seems to be coming unhinged: War raging in Ukraine and the Middle East, political divisions widening, mounting threats of nuclear war, economic uncertainty, and so on.

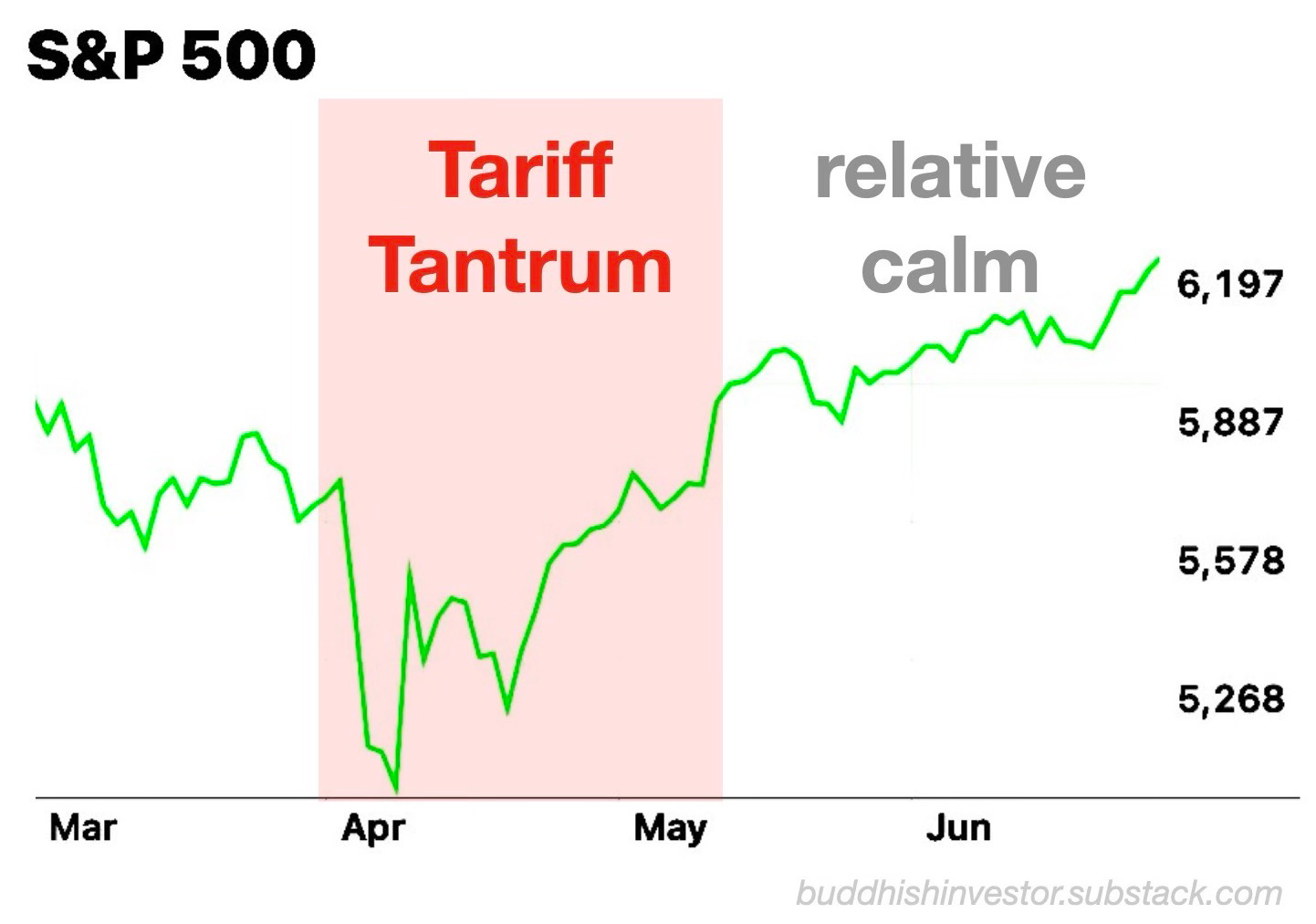

And yet the Market's been unnervingly calm for the past month or so:

What do we make of this?:

Is the Market just taking a breather from all the drama of the 'tariff tantrum'?

Or is it lying in wait for things to get really crazy?

Or maybe it's not too fussed about the state of things (despite the undeniable human tragedy)?

Or do we just not question it at all?

The sky keeps falling, but the Market keeps rising

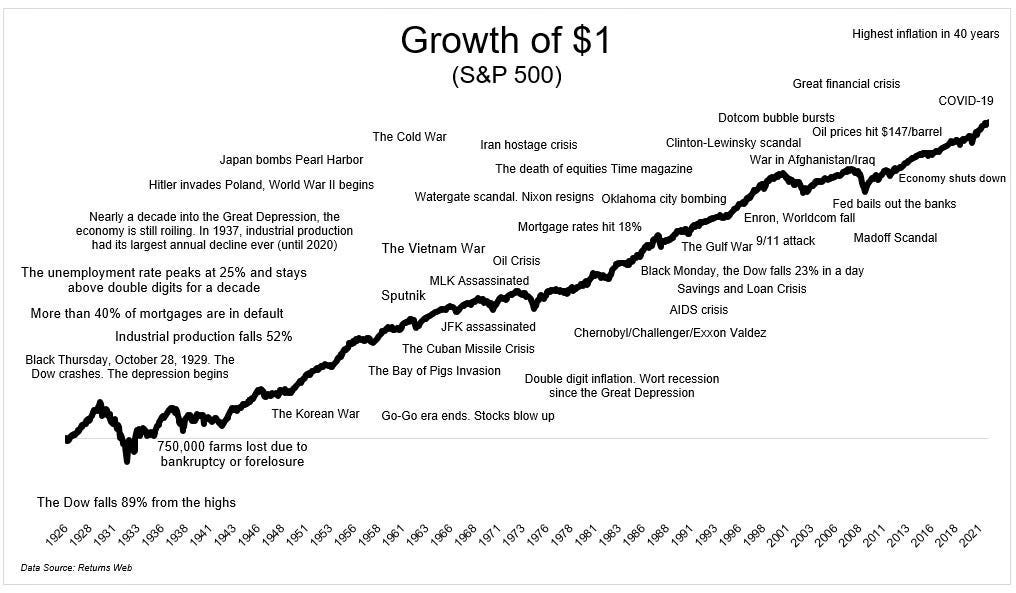

The Market has borne witness to much human turmoil over the years.

This legendary chart from Michael Batnick1 (a.k.a. The Irrelevant Investor) illustrates it beautifully:

My breath catches every time I see this chart.

We, as a civilization, have endured so much throughout our history.

Michael's chart ends in 2021, but the turmoil certainly hasn't. Over the past 4-5 years we've seen the pandemic, the meme stock craze, inflation, rising interest rates, crypto chaos, a banking crisis, US election uncertainty, a tariff tantrum and more:

Where does it end?

Well, it doesn't.

The sky will always keep falling. The world will always keep changing.

Impermanence and upheaval are the rules, not the exception. The Buddha taught this 2,600 years ago, and it still holds true today.

The Market knows this and continues plodding along.

We know it too, but we go to great lengths to convince ourselves otherwise. We like to think we’re in control. We’ll go as far as telling ourselves that the world is irredeemably screwed and beyond hope to perversely comfort ourselves. A bleak but knowable future is somehow more comforting than an unknowable one.

That’s how much we fear change.

It takes faith to be okay with change—especially as it is playing out in the world currently. Not faith that things will all work out right (because they won’t). Or faith in God (but to each their own). But faith in the true nature of reality. Faith, in this sense, is being open to reality unfolding as it will:

"The attitude of faith is to let go, and become open to truth, whatever it might turn out to be."

- Alan Watts

Kindness 100-baggers

We don’t know how the stock market will do over the next year or decade, yet we invest anyway. This is a radical act of faith, an embrace of uncertainty.

What if we took the same approach to working with the world around us? Invest in improving the world with no assurance of success.

We can dollar-cost-average2 into kindness:

Smile at the person on the sidewalk instead of averting your eyes.

Strike up a conversation with someone sitting next to you on the bus.

Follow the impulse to randomly text/call someone instead of convincing yourself out of it.

Hold the door open for someone.

All of these seemingly innocuous actions carry risk. Our kindness investment could go completely bust. The person next to us on the bus could tell us to “shove it.” The friendly text message might be ignored.

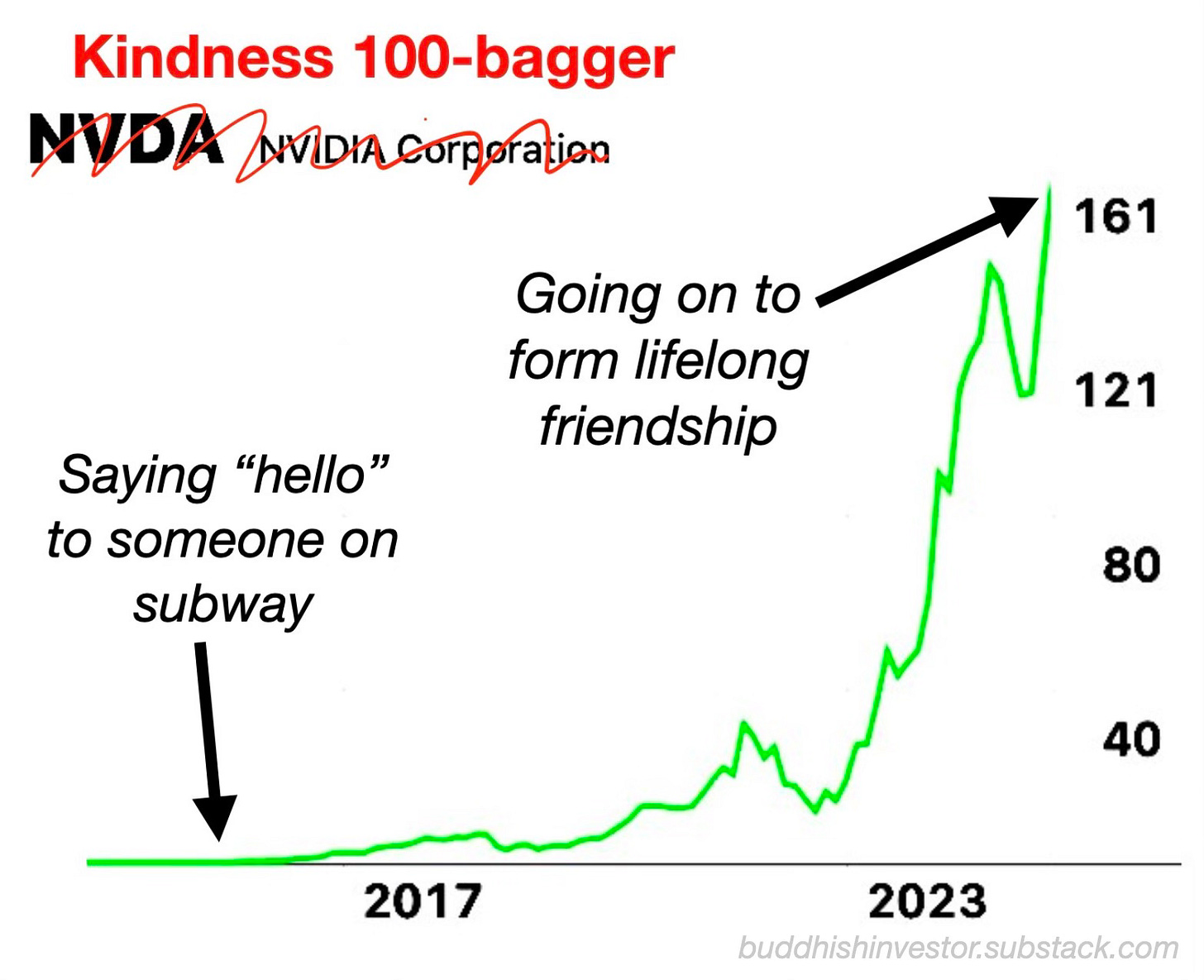

Or the investment could turn out to be a “100 bagger”3 (a stock, like NVIDIA, that returns $100 for every $1 invested):

We might strike up a new friendship or help pull someone back from the edge of despair or inspire them to pay the kindness forward. And this, in turn, could create even bigger ripples throughout Indra’s net, the web that connects us to each other and to everything else in existence.

By having faith in the fact that we don’t know the future, we free ourselves from the narratives that limit us. We allow ourselves to be curious and kind. And that’s what the world needs now more than ever.

- The Buddh-i$h Investor

Take home points:

Markets remain calm despite global chaos because they understand that impermanence and upheaval are the natural state of reality - something we humans know but resist accepting due to our fear of uncertainty.

We can apply investment thinking to kindness: make small acts of connection without knowing the outcome, embracing the faith that these "investments" might become 100-baggers that ripple through our interconnected world.

If you’re looking for more:

Cara Lai on embracing curiosity in this messed up world

The Intelligent Investor on the dangerous search for 100-baggers

Who kindly confirmed over email that the chart is indeed his. Thanks, Michael!

I couldn’t help myself from using this metaphor. Dollar-cost averaging is when we invest small, fixed amounts of money regularly over time. We can do the same with kindness in our day-to-day life.

Couldn’t resist this cutesy metaphor either.