Walking the Walk in Markets and in Life

You don’t understand risk—or Buddhism—until you’ve lived it

How okay are you with risk?

Could you stomach losing 10% of your portfolio?

20%?

50%?

90%?

I’ve always thought of myself as risk-averse. I shy away from speculative, risk-on type investments like options, crypto, or leveraged ETFs. I prefer a globally diversified mix of stocks and fixed income—a portfolio that feels, at least in theory, safe.

It runs in the family. My father keeps his money in Guaranteed Investment Certificates (GICs)1 with guaranteed but inflation-lagging returns. His father? He probably tucked spare cash under his mattress.

Early in my investing career, I would have said I could only handle a 10% drop, if that. The thought of losing my hard-earned savings felt unbearable.

But over time, my answer has changed. Not because I’ve become a thrill-seeker, or because I like risk any more than before. If anything, the stakes are higher now: I have a family, debt, and retirement on the horizon. I still don’t like risk.

But I know I can live with it. Because I’ve lived through it.

In 2020, when the COVID crash wiped 34% off the S&P 500 in a matter of weeks, I didn’t sell. I held steady and even kept buying. It was deeply uncomfortable—I wrestled with doubts all the way down and all the way back up. But I came out the other side, scarred and steadier.

That experience taught me more about risk than any book, blog, or podcast ever could. They told me drawdowns happen; they didn’t teach me what I would do in the middle of one.

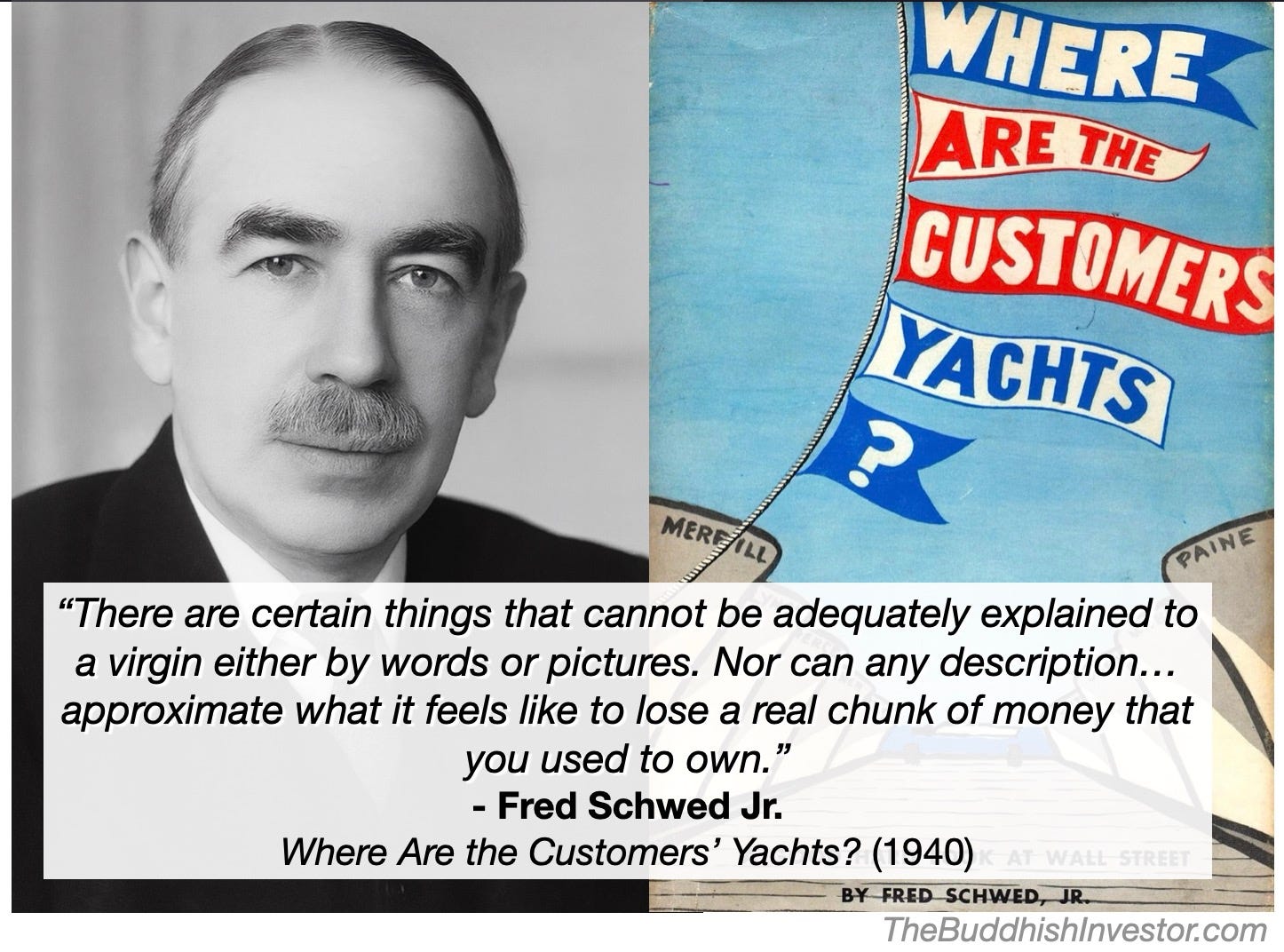

Legendary investing writer Fred Schwed Jr. said it best in his 1940 classic Where Are The Customers' Yachts? after living through the cataclysmic 1929 crash, which saw the market dip 90%2:

Schwed might as well have been talking about Buddhism too. You have to experience it to really get it.

I’ve spent hundreds of hours reading about its history and philosophy. I’ve accumulated a conceptual understanding. But concepts aren’t reality—they’re just our brain’s attempt to make sense of it.

I didn’t really understand Buddhism until I tried to live it. To “walk the walk” instead of just “talking the talk.” That practice has been uncomfortable too—challenging my view of myself, even reality itself. Accepting that suffering is unavoidable. Trying to get better at carrying it. Living more skillfully according to the Noble 8-fold Path.

Investing and Buddhism have both taught me this: you can’t learn what something feels like from the outside. You only learn by being in it.

Markets will crash. Life will hurt. The only real question is: when it happens, how will you carry yourself through it?

- The Buddh-ish Investor

I’d love to hear from you! Email at Sangha@TheBuddhishInvestor.com or drop a comment below!

Take home points:

You don’t really know your risk tolerance until you live through a downturn; the 2020 crash taught me more about investing than any book or podcast.

Like Buddhism, investing is something you can’t just study. You have to practice, endure discomfort, and “walk the walk” to truly understand it.

If you’re looking for more:

Take Vanguard Investor Questionnaire if you want to get a sense of your investing risk tolerance

I don’t want to lambast GICs. I’ve owned them before and probably will again. Definitely worth considering if you want to park cash that you’ll need in the short- to medium-term (e.g., new car, house down-payment, etc.)

Not sure I could stomach THAT kind of crash. From peak-to-trough, the market dropped 90% in total and took 25 years to post new highs. Meanwhile, the COVID-19 crash bounced back after only 6 months.